The installment-payment movement has gained the big e-commerce services provider Shopify Inc. as a convert with Wednesday’s announcement that Shopify will offer a credit option to its U.S. customers through Affirm Inc. San Francisco-based Affirm, an online credit-services provider, said approved Shop Pay customers at checkout will be able to …

Read More »Synchrony’s Retailers Suffer a Blow to Purchase Volume

The hits merchants are taking from the Covid-19 pandemic were apparent in the second-quarter financial results the big retail and cobranded card issuer Synchrony Financial reported Tuesday, results which include a 19% year-over-year drop in purchase volume. Stamford, Conn.-based Synchrony posted purchase volume of $31.2 billion versus $38.3 billion in …

Read More »Zelle Users at BofA Defy the Pandemic Gravity

Payment card usage in the U.S. might be taking a hit during the Covid-19 pandemic, but not the Zelle person-to-person payments service among Bank of America Corp.’s customer base. Charlotte, N.C.-based BofA reported Thursday that it had 11.3 million active Zelle users, including small businesses, in the second quarter, up 41% …

Read More »Big Banks See Credit Card Purchases Plunge by More Than 20% in the Second Quarter

Three of the nation’s largest banks reported Tuesday that their credit card purchase volumes fell by more than 20% in the second quarter as the Covid-19 pandemic slammed the brakes on the economy, though things were better on the debit card side. New York City-based JPMorgan Chase & Co., the …

Read More »Eye on the Point of Sale: Behind the Coin Shortage; The Decline in ATM Cash Withdrawals Slows

Consumers have been spending considerably less in most stores over the past four months, but that hasn’t prevented a shortage of coins from developing. But in one sign of a nascent revival of cash usage, the number ATM cash withdrawals by credit union members has finally broken a 15-week streak …

Read More »Contactless Transactions at Small Businesses Have More Than Doubled Since March

New data from a point-of-sale services provider show just how much of a boost the Covid-19 pandemic has given to contactless payments. New York City-based CardFlight Inc., a technology company serving more than 60,000 small businesses through its SwipeSimple service, says in its latest weekly report on payment trends since …

Read More »Report: Apple Testing QR Codes With Apple Pay

Apple Inc., whose Apple Pay is the leading mobile-payment service based on near field communication technology, reportedly is testing Quick Response codes as an alternative technology with Apple Pay. That development was first reported Tuesday by the 9 to 5 Mac blog, which said a second beta version of the …

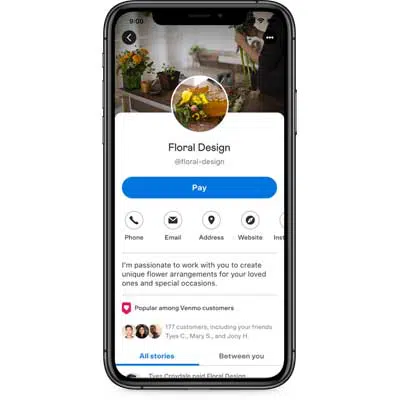

Read More »Venmo Testing a Mobile-Payments Service for Small Merchants

Taking a page from Square Inc.’s playbook, PayPal Holdings Inc.’s Venmo peer-to-peer payments service is testing what it calls Venmo Business Profiles, a potentially revenue-generating service that enables Venmo users who are sole proprietors of small businesses to sell goods through an affiliated page visible to other Venmo users. Announced …

Read More »Will Consumers’ Payment Habits Return to Their Pre-Covid-19 Patterns?

Before being upended by the Covid-19 pandemic, the payment choices U.S. consumers made were fairly stable. The biggest changes from 2018 to 2019 were an upswing in online bill payments and continued slippage in cash usage, according to new findings from the Federal Reserve Bank of Atlanta. Based on a …

Read More »New ACH Contact-Registry Rule Takes Effect With the Goal of Reducing Fraud and Exceptions

A new rule requiring all financial institutions in the automated clearing house network to participate in ACH governing body Nacha’s contact registry took effect Wednesday. The registry’s purpose is to enable financial institutions to quickly find the appropriate person to resolve issues when a transaction looks fraudulent or presents other …

Read More »