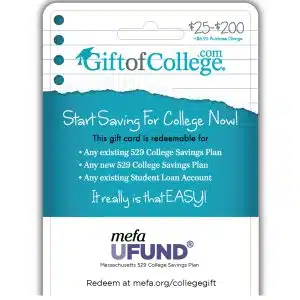

Paystone To Acquire Ackroo; MEFA Launches Gift Card program for College Tuition

Ackroo Inc., a Canadian gift card and loyalty platform, announced early Friday it has reached a “definitive” agreement to be ...

The ABA’s Letter to the Fed Is the Latest Salvo in the Battle Over Debit Card Interchange

The American Bankers Association on Thursday issued a long and detailed letter it has sent to the Federal Reserve Board ...

Extra Bill Pay Costs up 18%, doxo Says and other Digital Transactions News briefs from 12/13/24

So-called hidden costs—such as overdraft charges, late fees, and identity fraud—linked to bill payments amount to $196 billion on an ...

Slope Taps Marqeta for a B2B BNPL Card; Equipifi Partners With Synergent on BNPL

Slope, a provider of buy now, pay later solutions for business-to-business transactions, announced early Thursday it will use Marqeta Inc.’s ...

Visa Direct Will Define Real Time As One Minute—Or Less

Visa Inc.’s move to speed up its Visa Direct service to no more than one minute, starting in April, is ...

Nuvei’s Google Pay Expansion and other Digital Transactions News briefs from 12/12/24

Canada-based processor Nuvei Corp. announced an expansion of its Google Pay offering to merchants throughout Latin America. The company already offers the ...

Overhaul Your Payment Processing with Payarc’s PAYFAC Platform

Empower Your Business with Seamless Transactions In today’s digital ecosystem, software companies have a wide range of options to create ...

HungerRush Debuts Order Notifications Feature; Condado Tacos Adds Par Technology’s Back Office Apps

HungerRush, a provider of restaurant-management and online-ordering solutions, has sought to strengthen its hand in the highly competitive restaurant point-of-sale ...