Sensing an opportunity to expand the reach of its financial services to more small businesses, Intuit Inc. on Tuesday introduced Money by QuickBooks, a mobile app intended to make it easier for small sellers to accept payment, manage their cash flow, and pay bills.

Intuit launched the app in response to the trend of new business owners, such as freelancers, entrepreneurs and sole proprietors, increasingly turning to digital, mobile-first offerings. A recent study by QuickBooks found that 30% of businesses that process payments using mobile-payment apps started doing so during the pandemic.

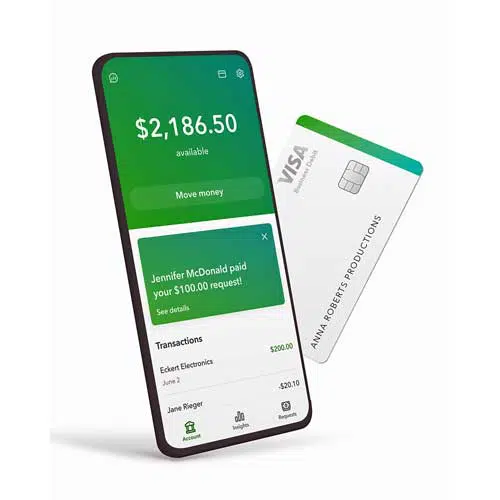

After downloading the app, which is free in the iOS and Android stores, businesses can apply for a Money by QuickBooks account, which has no monthly fees or minimum-balance requirements. Account openings are subject to identity verification and approval by Green Dot Bank, which provides banking services for Intuit’s financial services.

Once an account is approved, businesses can request and accept payments in myriad ways, including debit, credit, and ACH transfer, without the need for their customers to have the app. Businesses can also access deposits for same-day receipt at no extra fee for payments accepted through the app, or by using the free QuickBooks Visa business debit card, which enables access to over 19,000 Allpoint ATMs nationwide. Businesses can make up to four ATM withdrawals per statement cycle.

In addition, businesses can track income and expenses through the app, as well as schedule and pay bills by check or ACH payments. All accounts are FDIC-insured up to $250,000.

“The pandemic has driven the number of small-business starts to historic highs, and we have a unique opportunity to expand the reach of our financial-services expertise to even more new entrepreneurs,” Rob Daniel, director of product management for Intuit QuickBooks Money Offerings, says in a prepared statement. “These small businesses tell us they want fintech to help them feel in control of their money and cash flow.”

By expanding the reach of Intuit’s financial services to small businesses, Money by QuickBooks appears to be a direct competitor to Square Inc.’s core business of equipping merchants with software and hardware to sell goods.

“[Money by QuickBooks] is a strong competitor to Square’s SMB solution. It’s priced more aggressively and, beyond that, it’s a great point of entry for a small business that might need additional capabilities such as those offered by QuickBooks,” Thad Peterson, strategic advisor, retail banking & payments at

Aite-Novarica Group, says by email. “Importantly, it’s offering banking services through Green Dot, and it could potentially have a greater impact on banks than on Payfacs like Square.”

Offering Money by QuickBooks as a mobile app is also likely to make the app more appealing to Millennials and Gen-Z’ers, especially the next wave of SMB entrepreneurs to emerge from those generations, as both generations readily embrace mobile technology, Peterson adds.

Money by QuickBooks is the latest tool from Intuit aimed at small businesses for payments acceptance. In July, Intuit introduced the QuickBooks Card Reader for small businesses. The terminal supports what Intuit calls smart-tipping functionality, enabling businesses to customize three tipping options that are displayed on the card reader as a percentage of the total amount or as a flat-dollar amount.