One impression of consumers who use buy now, pay later services is that they may not be as financially literate as others. New data from Capterra, a software reviews and selection platform, indicate that picture may not be entirely accurate.

In Arlington, Va.-based Capterra’s “2022 Buy Now, Pay Later Survey,” 95% of consumers say they’re confident in their ability to make their next payment on time. And 57% of consumers say they are more likely to use BNPL again.

Critics claim BNPL services may produce situations where consumers are over-extended or unable to make payments. That sort of risk was part of a Consumer Financial Protection Bureau report on BNPL released in September. When informed the CFPB may regulate BNPL, 57% of consumers say they’re more likely to use the payment option. Capterra surveyed 349 consumers in November.

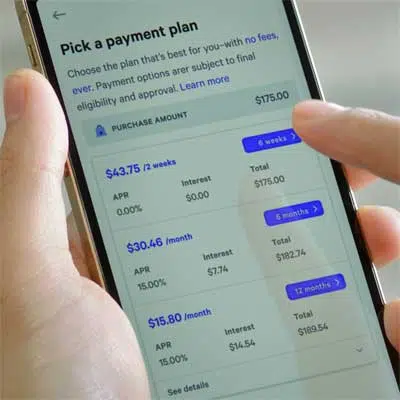

Still, some consumers see hurdles to using BNPL. Seventy-one percent said they would not use BNPL out of concern over hidden interest costs, just as 54% would not because they fear harm to their credit scores. Fifty-three percent were concerned about late fees.

With fears of a potential recession rampant, consumers may be more likely to shop at merchants that offer BNPL, with 66% of them saying they are more likely to shop at merchants that offer BNPL options.

As for the debt and timely payment element, only 26% say they’ve forgotten a payment was coming up. Many consumers—47%—have existing BNPL payment obligations or have from than $100 to more than $5,000 in debt.

“Responsible payment offerings are of utmost importance for businesses using BNPL, especially because users are primarily younger and minority groups who are more likely to have no credit history,” Max Lillard, Capterra senior finance analyst, said in a statement. “When implemented correctly, business can help customers access previously gated financial opportunities, and in some cases, help them build credit.”

The Capterra survey found that Black—46%—and Hispanic/Latino—56%—groups were more likely to use BNPL services. Forty-five percent of Millennials and 33% each of Gen Z and Gen X populations financed at least one purchase using a BNPL service.