A potential merger, joint venture, or partnership may be in the offing for Global Payments Inc. and Total System Services Inc. (TSYS). The two merchant-processing powerhouses have held preliminary discussions about a combination of some sort, according to a report late Thursday by Bloomberg.com. In addition to traditional merchant processing, …

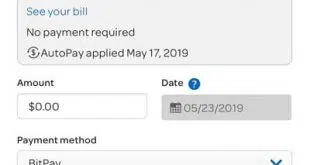

Read More »AT&T Says It’s Now the First Mobile Carrier to Accept Cryptocurrency for Bill Payments

AT&T Communications said on Thursday that starting now it will accept bill payment in cryptocurrency, making it the first mobile carrier, and one of the largest companies overall, to do so. The company, a unit of AT&T Inc., is using Atlanta-based processor BitPay Inc. to handle digital-currency payments. No information …

Read More »A New Survey Casts Doubt on the Idea That Contactless Cards Will Trigger More Mobile Payments

Conventional wisdom in the payments business has been that the advent and spread of contactless cards would pave the way for wider use of mobile payments. But research released this week indicates that may not be the case. Indeed, far from serving as the training wheels for mobile payments, new …

Read More »AmEx Acquires Resy Reservation Platform; Shift4 Unveils Pay-at-Table System

Payments firms continue to strengthen their offerings in the dining sector as evidenced by Wednesday’s announcements from American Express Co., which said it had acquired reservation platform provider Resy Network Inc., and Shift4 Payments, which is launching a pay-at-table system called SkyTab and providing it to new merchants at no …

Read More »SurchX Debuts Online Surcharge Service and other Digital Transactions News briefs form 5/13/19

SurchX, a surcharging specialist, launched SurchX for e-commerce platform Magento. SurchX automatically calculates surcharges and fee structures based on card type and jurisdiction. The fee can be passed on for the consumer to pay. Payments provider ACI Worldwide said its real-time payments technology is supporting BMO Financial Group’s efforts to …

Read More »Factors Align for Widespread U.S. Contactless Payments Adoption, A Fed Study Suggests

The conditions for the widespread adoption of contactless payments using chip cards are in place, asserts a new report from the Federal Reserve Bank of Boston. But when that will happen and what will trigger it are unknown in the Fed report, “Tap to Pay: Will Contactless Cards Pave the …

Read More »As Discover Found Out, Some Cash Rewards Will Bite Harder Than Others

Merchants and card issuers long ago discovered the value of cash in driving transaction volume, but on Thursday Discover Financial Services demonstrated how expensive some rewards categories can be. Discover reported $677 million in discount and interchange revenue for the first quarter, up 5% from the same quarter last year. …

Read More »Venmo Has More Than 40 Million Users, But It Remains a Tough Margin Puzzle for PayPal

There’s much more to PayPal Holdings Inc. than Venmo, but that’s where the payments industry’s spotlight has shone in recent months. So on Wednesday, PayPal for the first time revealed how many active users its peer-to-peer transfer service has: 40 million plus. Venmo users rang up $21 billion in volume …

Read More »Bleumi Combines Stablecoins And Blockchain for a Cross-Border Remittance Service

Blockchain startup Bleumi Inc. announced Tuesday it has launched two services, Bleumi Pay and Bleumi Invoice, for cross-border remittances. Bleumi Pay, a gateway that works with so-called stablecoins to avoid the price volatility afflicting cryptocurrencies like Bitcoin. The gateway will allow businesses and merchants to receive payments via Web site, …

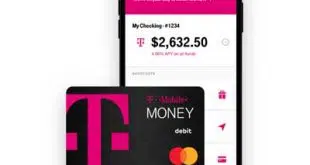

Read More »In a Return to Mobile Financial Services, T-Mobile Launches Its Money App Nationally

In a sign that at least some U.S. wireless carriers haven’t given up on their ambitions in mobile payments, T-Mobile US Inc. on Thursday launched its T-Mobile Money service nationwide. But the service, which began as a pilot in November, goes beyond payments offerings to include some traditional banking services …

Read More »