FundKite, a fintech that provides financing to small and medium-size businesses, has broadened its services with the launch of a payment-processing division. The move will enable FundKite to expand its services beyond offering capital to merchants by providing them with a one-stop processing and financing shop, the company says. In …

Read More »Nuvei Readies UAE Expansion and other Digital Transactions News briefs from 6/25/24

The Canada-based processor Nuvei Corp. said it has received approval for a retail-services license from the central bank of the United Arab Emirates, laying the groundwork for an expansion into the UAE market. Fast-food chain Long John Silver’s said it is working with multiple technology vendors to update its digital and in-store ordering experience …

Read More »BNPL Displacing Store Cards and other Digital Transactions News briefs from 6/3/24

Buy now, pay later installment plans are displacing store cards among consumers, with 64% of debit card holders reporting they have been offered an installment plan online, up from 45% four years ago, according to The Payments Report from Auriemma Research. Meanwhile, 39% report they own a store card, down from 53% …

Read More »COMMENTARY: Why Merchants Should Embrace Network Tokenization

If you know anything about the payment space these days, you know that the natives are restless. Merchants have been fed up with interchange rates for years, with no shortage of lawsuits to voice their complaints. Even after winning the right to pass on interchange costs to the consumer, merchants …

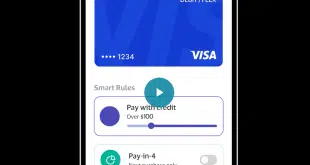

Read More »Visa Revamps its Payments Approach

Visa Inc. is taking up the notion of a digital payment identity and making it part of its product mix. Announced Wednesday at the Visa Payments Forum in San Francisco, the Visa Flexible Credential is but one of several products the payments network formally debuted, including broader tap-to-pay capabilities, a …

Read More »Mastercard Begins Domestic China Processing and other Digital Transactions News briefs from 5/10/24

Mastercard Inc. has started processing card payments domestically in China, working with its partner NetsUnion Clearing Corp. (NUCC), China’s nationwide processing platform. Gift card and loyalty provider Factor4 completed an integration with commerce services provider Shopify Inc. that enables Shopify customers to sell and accept physical and digital gift cards in store and …

Read More »Behind Open Banking’s Growing Appeal to Consumers, Merchants—And Card Networks

Open banking has been attracting the attention of bankers, merchants, and card networks. It’s also drawing notice from regulators. The concept of making a payment through a direct transfer from a bank account can appeal to consumers because it’s fast and easy, and to merchants because the transaction is reportedly …

Read More »Pax Unveils Vendall and other Digital Transactions News briefs from 5/8/24

Point-of-sale terminal company Pax Technology Inc. launched Vendall, a payments system for vending machines, minimarkets, and other unattended markets. Nacha, the automated clearing house governing body, noted the 50th anniversary of its formation, noting there were 31.5 billion ACH network payments made in 2023 valued at $80.1 trillion. In related news, Phixius, a …

Read More »PayNearMe in Trustly Deal and other Digital Transactions News briefs from 5/7/24

PayNearMe, a payments provider for iGaming, online sports betting, and other markets, announced it is integrating open banking capability through a new agreement with Trustly. Visa Inc. launched Visa Account Attack Intelligence, a platform that harnesses generative artificial intelligence to generate a score indicating the probability of card-testing attacks by fraudsters …

Read More »PayNearMe Enables Cash Toll Payments on Cashless Tollways

Growth in cashless tollways has been a boon for moving traffic. Now, PayNearMe Inc., a fintech that enables paying for online transactions with cash among other payment methods, says it is working with Kapsch TrafficCom to enable a way for those without access to in-car wireless toll payments to pay …

Read More »