Visa Inc. is taking up the notion of a digital payment identity and making it part of its product mix.

Announced Wednesday at the Visa Payments Forum in San Francisco, the Visa Flexible Credential is but one of several products the payments network formally debuted, including broader tap-to-pay capabilities, a passkey service, pay by bank, and added security for account-to-account payments.

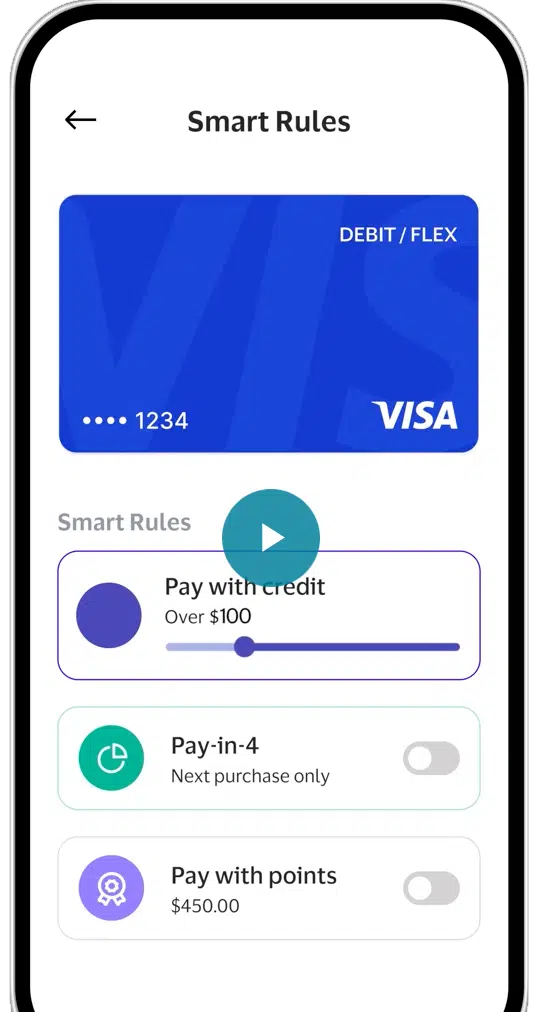

The Visa Flexible Credential is a tool that Visa says will enable consumers to access multiple accounts via a single credential. It enables a single card product to toggle between payment methods, such as debit, credit, buy now, pay later, or pay with rewards points. Live in Asia, it will launch in the U.S. market later this year with Affirm Inc., an installment-payments provider. In an example, a consumer at the checkout might open a card issuer’s app and select a different funding source.

Visa also is bolstering its pay-by-bank capabilities by digitizing these transactions through open-banking technology. Using technology from its Tink AB acquisition, Visa in one example is connecting consumers and their banking accounts to make easier payments using the automated clearing house network.

Closely connected to this, Des Moines, Iowa-based Dwolla Inc. says it is working with Visa to use the card brand’s account-verification capabilities with Dwolla’s account-to-account payment service. This will help mid- and enterprise-size merchants pay and get paid via their bank accounts, Dwolla says.

Visa also is focusing on tap-to-pay options. In addition to tapping to pay using a conventional smart phone with no specialized point-of-sale hardware, Visa says it is incorporating tap to confirm, which can authenticate a consumer’s identity when shopping online, and tap to add card, which has extra security when adding a card to a wallet or app. It also is integrating tap to P2P payments, which enables consumers to send money to family and friends.

Visa also is adopting passkey technology, which can confirm a consumer’s identity and authorize an online payment with a scan of his or her biometrics identifier, such as a face or fingerprint. Built on standards from the FIDO Alliance, the passkey technology also is being coupled with Click to Pay, an online checkout service that enables issuers to enable Click to Pay and Visa Payment Passkey Service on new Visa cards, which can reduce manual entry of card details and passwords.

Visa is also extending security technology to account-to-account payments. Live in Latin America and in tests in the United Kingdom, this service works with real-time payments networks to use Visa fraud-detection capabilities in account-to-account transfers.