Ontario International Airport in California is adopting Shift4 Payments Inc.s’ VenueNext mobile point-of-sale technology to allow passengers to order and pay for food and merchandise using their mobile phones. The service includes new self-checkout technology that allows travelers to scan a UPC code, add it to a shopping cart, and …

Read More »Crypto, Gift Cards, And Even BNPL Come to Unattended Payments Via PayRange

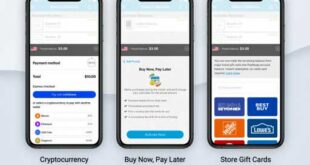

Transactions on gift cards and cryptocurrency—and even buy now, pay later capability—are coming to commercial washers, dryers, and vending machines with an announcement Monday by PayRange Inc. that it will support the new payment methods. The Portland, Ore.-based company, which says it processes for more than half a million commercial …

Read More »U.S. Merchant Acquiring Volume Surpasses $9 Trillion Even As E-Commerce Slows

The 25 biggest U.S. merchant acquirers control about 90% of payment dollar volume, even as e-commerce may be losing some of its recent momentum, according to the latest ranking of U.S. merchant acquirers by The Strawhecker Group, released this week. Overall, U.S. acquirers processed more than $9 trillion in payment …

Read More »Losses From Stolen Identities Skyrocketed 79% to $24 Billion in 2021, a Javelin Study Finds

Payments providers are increasingly resuming business-as-usual as the pandemic eases, but so are criminals. Losses from identity-fraud schemes, in which fraudsters use stolen payment credentials for their own gain, soared 79% last year to $24 billion, according to a study released Tuesday by Javelin Strategy & Research. Moreover, this so-called …

Read More »Eye on Security: Panini Meets FBI Standards, And VGS Gets Set to Launch Card Tokens

Panini S.p.A., which has been expanding beyond its base in devices for image processing, said early Tuesday the Federal Bureau of Investigation has certified its fingerprint-authentication technology, called BioCred. The scanning technology meets image-quality specifications set by the FBI’s Appendix F standard, said to be the law-enforcement agency’s highest standard …

Read More »Eye on the Sky: CellPoint Signs Virgin Atlantic, And Garmin Unveils a New Smart Watch

The return of travel following the impact of the pandemic is testing airlines in various ways, not the least of which is their openness to payment methods beyond cards in what for them is a global market. That new emphasis, combined with a need to work with multiple acquirers, is …

Read More »As Regulators Examine BNPL, A Payments Industry Group Advises Caution

With the Consumer Financial Protection Bureau investigating the impact of buy now, pay later programs on consumers, the Electronic Transactions Association early Friday released a letter it hopes will help clarify the issues and help allay the regulator’s concerns about key issues such as debt accumulation, regulatory arbitrage, and data …

Read More »Mastercard Announces Account-to-Account Payment Tools Based on Open-Banking Assets

Mastercard Inc. early Wednesday said it will launch two new payments tools that rely on the card network’s rapidly growing stake in open banking and account-to-account transactions. The new digital tools, which Mastercard says will not be available until later this year, are expected to address risk and uncertainty in …

Read More »Fast-Growing BNPL Will Capture ‘Additional Share,’ Including Offline Spend, An Analyst Says

The buy now, pay later concept is nothing new, but it took on momentum during the pandemic and may now undergo unstoppable growth in the next few years, according to RBC equity analyst Dan Perlin, who analyzed data on BNPL contained in the 2022 Global Payments Report recently released by …

Read More »The Big Global Processor Worldline Reports a Small Revenue Exposure in Russia

The world’s biggest card networks earlier this month reacted to the Russian invasion of Ukraine by closing their operations in Russia, and now some of the world’s biggest processors are beginning to report their exposure to those markets. For Paris-based Worldline S.A., it’s not trivial, but it’s not huge, either. …

Read More »