Despite some claims to the contrary, the odds are long that merchants would pass on any potential savings to consumers from the Credit Card Competition Act, payments experts say. One argument for this is that merchants price products on a line-item basis, which means the savings on a single product …

Read More »Search Results for:

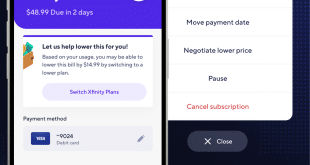

Atomic Looks to Ease the Subscription Economy for Consumers Via a New App That Works Inside Banks’ Apps

Recurring payments like subscriptions have been gaining increasing attention as more businesses supplement one-off sales and as banks and billers look for ways to automate the process for consumers within their own apps. Now the capability to make and control recurring payments is coming to consumers on their mobile phones. …

Read More »Eye on Dining POS: NCR Voyix’s QR Code App; Olo Works With MenuSifu

Point-of-sale technology for the ultra-competitive restaurant market gained even more momentum Monday as several key players unveiled new solutions. The announcements were in conjunction with the annual National Restaurant Association show taking place in Chicago. Digital-commerce technology platform NCR Voyix Corp., formerly NCR Corp., introduced its Aloha Pay-At-Table technology, an …

Read More »COMMENTARY: Why Merchants Should Embrace Network Tokenization

If you know anything about the payment space these days, you know that the natives are restless. Merchants have been fed up with interchange rates for years, with no shortage of lawsuits to voice their complaints. Even after winning the right to pass on interchange costs to the consumer, merchants …

Read More »A Bill That Would Cut the Number of Banks Covered by Durbin Advances Out of Committee

A bill containing a provision that would raise the asset threshold for debit card issuers covered by the Durbin Amendment narrowly passed in a vote late Thursday by the House Financial Services Committee. The committee voted 24-22 in favor of advancing the bill, called the Bank Resilience and Regulatory Improvement …

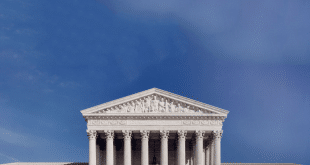

Read More »Will Its Supreme Court Victory Embolden an Already Activist CFPB?

The Consumer Financial Protection Bureau’s victory at the Supreme Court on Thursday answers for now the question of its constitutionality and may quiet the agency’s critics, who view it as a largely unnecessary agent of federal power operating with an overly aggressive agenda. But some payments experts fear the decision, …

Read More »Eye On Restaurants: NCR Voyix Launches a Self-Service Kiosk; Lightspeed’s Q4 earnings

Digital-commerce technology provider NCR Voyix Corp., formerly part of NCR Corp., has partnered with self-ordering software provider GRUBBRR to introduce a new ordering kiosk for restaurants. The kiosk, which integrates with NCR Voyix’s commerce platform, was developed as a response to consumers’ growing preference for self-service ordering, the company says. …

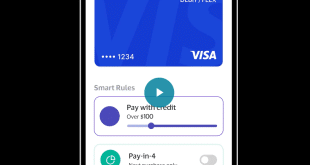

Read More »Visa Revamps its Payments Approach

Visa Inc. is taking up the notion of a digital payment identity and making it part of its product mix. Announced Wednesday at the Visa Payments Forum in San Francisco, the Visa Flexible Credential is but one of several products the payments network formally debuted, including broader tap-to-pay capabilities, a …

Read More »Supreme Court Upholds CFPB Funding and other Digital Transactions News briefs from 5/16/24

The U.S. Supreme Court early Thursday upheld the constitutionality of the Consumer Financial Protection Bureau by a 7-2 vote, reversing an October 2022 ruling by a federal appeals court in New Orleans that had held the means by which the bureau is funded violates the U.S. Constitution. The CFPB, created in 2008, receives its …

Read More »Eye On Travel: Worldline’s Virtual Card Platform; Consumers Are Traveling More

The big processor Worldline S.A. is working with Visa Inc. to launch a virtual business-to-business card-issuing facility for online travel agencies. The deal marks the first foray for Paris-based Worldline beyond payment processing. The partnership will integrate Worldline’s Merchant Services Acceptance capabilities with its Financial Services Card issuing platform to …

Read More »Eye on ISVs: Booksy Adds Tap to Pay on iPhone; Usio Could See $20 Million in Revenue From a Single ISV

With an eye to making it easier for consumers to pay how they want, Booksy Inc., a booking platform for beauty-service appointments, is adding Tap to Pay on iPhone as an option. The contactless payment method enables consumers to use their contactless credit or debit cards, or an iPhone with …

Read More »Flywire Widens Invoicing Access and other Digital Transactions News briefs from 5/15/24

Flywire Corp., a specialist in payments for higher education, said it has widened the availability of its third-party invoicing platform, which lets third parties pay tuition and fees on behalf of students. Buy now, pay later provider Afterpay said Gen Z consumers—those born between 1997 and 2012—increased first-quarter 2024 spending at small …

Read More »Merchants And Banks Prepare for Battle Over the Fed’s Proposed Debit Adjustments

The National Retail Federation and the Merchants Payments Coalition have lined up against the Federal Reserve, arguing that while a rate reduction on debit card transactions is welcome, the Fed’s proposed pricing does not go far enough. The two industry trade groups sent their respective letters to the Fed on …

Read More »Results Improve for Paysafe As the Processor Looks to Beef up Its Internal Sales Staff

Paysafe Ltd. wants to do more to sign merchants directly, and to that end it’s hiring salespeople—lots of them. The London-based merchant processor, which has a big operation in North America and aspirations for a larger one, hired 55 salespeople in the first quarter and plans to add 170 in …

Read More »Square’s Restaurant Boosts and other Digital Transactions News briefs from 5/14/24

Block Inc.’s Square point-of-sale technology unit announced a slew of restaurant initiatives, including a link with distributor Performance Foodservice to market Square to 125,000 U.S. and Canada-based clients; integrations with dining-technology providers; links to restaurant associations in Illinois, California, and New York state; and a recommendation engine based on machine learning. Square …

Read More »Consumer Delinquencies Are Piling up As Covid Stimulus Wears Off

As the effects of the economic stimulus pumped into the economy by the federal government during the pandemic wear off, consumers are having a harder time paying their recurring debts on time. A study released Monday by Achieve, a San Mateo, Calif.-based provider of debt-management programs for consumers, reveals that …

Read More »Eye on Restaurants: Digital POS Hasn’t Changed Tipping Much, Survey Says; Shift4 Acquires Revel

More Americans are being asked to tip, but it doesn’t seem to have much positive impact for some workers, especially those employed by restaurants. Only 29% of these workers say their tips have increased in the past year, according to the “Beyond Gratuity: Perspective of Restaurant Staff Tipping Practices” report …

Read More »Just 38 Developers Take Apple’s Offer and other Digital Transactions News briefs from 5/13/24

Just 38 app developers have so far applied to Apple Inc. to enable payment processors outside of Apple’s proprietary payment system, the iPhone maker said. That’s out of 65,000 developers that were eligible to apply, according to Bloomberg. The report follows legal action that required Apple to make the alternatives available for apps. Ohio-based …

Read More »EarnUp Launches a Text to Pay Option for Mortgage Lenders

Text-to-pay technology received a boost late Thursday as San Francisco-based fintech EarnUp Inc. launched a text-to-pay app for mortgage lenders. The white-label app allows lenders to send text reminders of upcoming mortgage payments with an embedded link to make payments using a debit card. Consumers can initiate payment using Apple …

Read More »Growth in Payments Helps Boost Middle-Market Processors, Too

Payments processors haven’t had it easy in recent years, what with a pandemic-led shift to e-commerce on the part of brick-and-mortar merchants, a deluge of new and more complicated point-of-sale technologies, and growth by industry giants like Fiserv Inc. and Global Payments Inc. But many of the midsize players grew, …

Read More »