Recurring payments like subscriptions have been gaining increasing attention as more businesses supplement one-off sales and as banks and billers look for ways to automate the process for consumers within their own apps. Now the capability to make and control recurring payments is coming to consumers on their mobile phones.

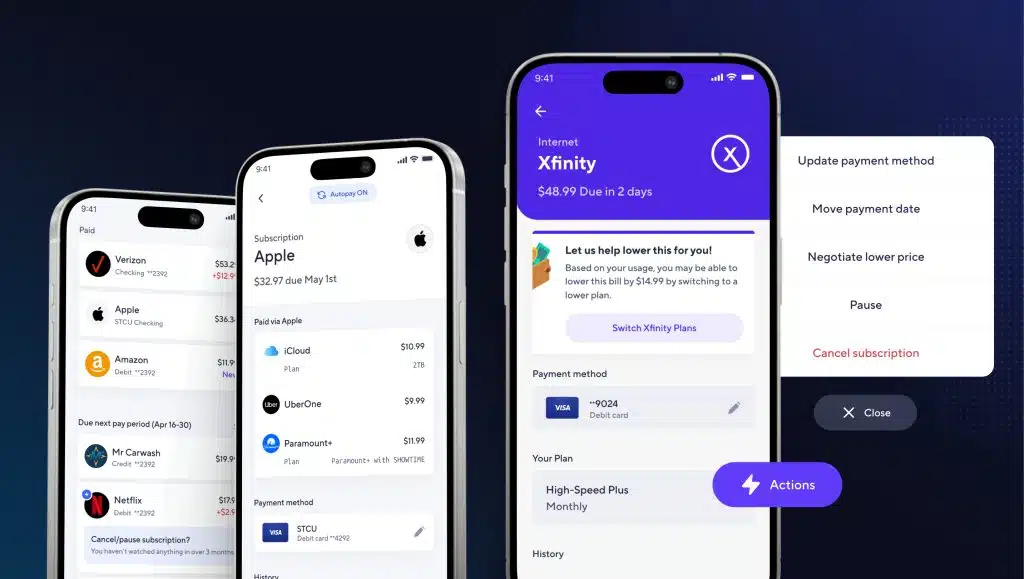

The latest example is Atomic Financial, a Salt Lake City-based company that says it’s giving consumers the ability to view and pay bills within their banking app. The new Atomic app, called PayLink Manage, lets users reschedule payments, issue payments on a specific date, and cancel subscriptions, as well, the company says. Frost Bank, with nearly 200 locations in Texas, is one of the earliest financial institutions to adopt the technology from 5-year-old Atomic.

The company says direct connections allow it to present to consumers options on recurring bills that can be executed in real time and without resorting to a separate app. Besides immediate payment, options include rescheduling payments, canceling a payment, and issuing payments on specific dates.

“We’re confident that within a few years subscription management will become a must-have feature in any leading consumer banking application,” says Atomic cofounder and chief executive Jordan Wright, in a statement.

For financial institutions, adoption of the app within their banking apps can inform cross-sell efforts to customers based on data gathered from customers’ spending, Atomic says.

The new app, which is free to users, arrives as the subscription market is forecast to grow to $1.5 trillion by next year, according to numbers from Digital Route, which follows the business.