Apple Inc. says iPhone users will be able to send funds to each other by simply holding their iPhones next to each other. It’s a further refinement of Apple’s financial services, which jumped off in 2014 with the launch of Apple Pay. In a video presentation Monday, Apple executives say …

Read More »NMI’s Shopify Integration and other Digital Transactions News briefs from 6/11/24

Payments provider NMI announced what it calls an “enhanced” integration with Shopify, the Canada-based e-commerce platform. The integration is meant to assure independent sales organizations and software providers that integrations comply with updated Shopify requirements. Chase Payment Solutions has brought its Tap to Pay on iPhone capability to Canada, with beauty retailer Sephora …

Read More »Entrust Launches Digital Identity Verification for Government Benefits And Services

Entrust Corp., a provider of identity technology, on Monday launched its Citizen Identity Orchestration platform, which is aimed at governments’ delivery of public services. The new platform, intended for such functions as benefits delivery, tax filing, health-care access, and border crossings, uses artificial intelligence for identity verification, issuance of digital …

Read More »Mastercard’s AI-Powered Shopping Muse Has Been Deployed by Michael Kors

Retailer Michael Kors is getting into the artificial intelligence-powered shopping recommendation business with the adoption of Shopping Muse, a recommendation engine from a Mastercard Inc. company. Developed by Dynamic Yield, a data-personalization platform Mastercard acquired from McDonald’s Corp. in 2022, Shopping Muse employs artificial intelligence to make recommendations and further …

Read More »Maverick’s Visa Integration and other Digital Transactions News briefs from 6/10/24

Maverick Payments said it is working with Visa Inc. to offer direct acquiring capability on the Visa Acceptance Platform. The new connection, expected to go live in the third quarter, will let Maverick resellers and merchants gain access to a direct link to VisaNet. Google Inc. has discontinued GPay, or Google Pay, …

Read More »The U.S. Payments Forum Looks to Multi-Factor Authentication to Fight Phishing

As criminals’ knowledge of how to beat multi-factor authentication through phishing schemes increases, the need for payment providers to implement phishing-resistant solutions continues to grow. Phishing attacks are a form of social engineering in which cybercriminals deceive consumers into revealing personal and account information. The cybercrime can also involve installation …

Read More »Elavon Expands in Mass Transit With Contactless Fare Payments on Philadelphia’s SEPTA

In a major win in the expanding market for digital payments for mass transit, Elavon Inc. said it will support contactless payments for the Southeastern Pennsylvania Transportation Authority, the seventh largest U.S. transit system with 45.6 million riders per year, according to the American Public Transportation Association. The new service, …

Read More »35% Intend To Add Faster Payments and other Digital Transactions News briefs from 6/7/24

The U.S. Faster Payments Council released its “Faster Payments and Financial Inclusion” survey report that found that 35% of respondents did not have a faster payments integration but planned to do so. The survey canvassed 88 organizations. Technology firm EvonSys Inc. launched its Evonsys Payments Platform for cross-border transfers. The new service integrates capabilities …

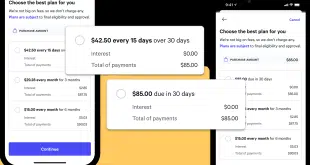

Read More »Affirm Adds New Payment Options And Partners to Attract Omnichannel Merchants

Buy now, pay later provider Affirm Holdings Inc. has expanded its payment options to include Pay in 2 and Pay in 30. The new BNPL options are intended to provide consumers with more flexibility in budgeting their monthly income, the company says. Data from the Bureau of Labor Statistics shows …

Read More »Canadian Customers Are Losing Enthusiasm for Credit Card And Banking Apps And Sites

Banks and credit card companies have launched online services and mobile apps over the years to reinforce ties to their most valuable customers and win new ones. But, in Canada at least, that effort is hitting a brick wall, a series of new reports from J.D. Power indicates. While Canadian …

Read More »