Apple Inc. says iPhone users will be able to send funds to each other by simply holding their iPhones next to each other. It’s a further refinement of Apple’s financial services, which jumped off in 2014 with the launch of Apple Pay.

In a video presentation Monday, Apple executives say the new feature will be part of its iOS18 operating system for its mobile devices. That software is typically released in the autumn. Apple also shared a slide that indicated Apple Pay would become available for third-party browsers later this year. Apple says Apple Pay can be used with any third-party Web browser and computer by scanning a code on their iPhone to complete the payment.

Apple provided no details on how Tap to Cash works other than showing two iPhones being held close to each other with a Ready to Send page displayed on one device without having to share phone numbers. It could work by using the near-field communication chips in iPhones, which allow for short distance, secure connectivity.

Also, the Tap to Provision tool enables users to add eligible cards to Apple Wallet by tapping their card to the back of their iPhones.

In another development, Apple says it expects to make Affirm Inc.’s buy now, pay later service available to U.S. Apple Pay users later this year. In an 8K filing with the U.S. Securities and Exchange Commission, Affirm says its BNPL payment method will be available online and in-app with Apple Pay on iPhone and iPad. Apple says users will be able to apply for an Affirm loan directly through Affirm when they check out with Apple Pay.

Apple launched its own BNPL service, called Apple Pay Later in 2023, after having announced it in 2022. Apple self-funded Apple Pay Later through its Apple Financing LLC subsidiary.

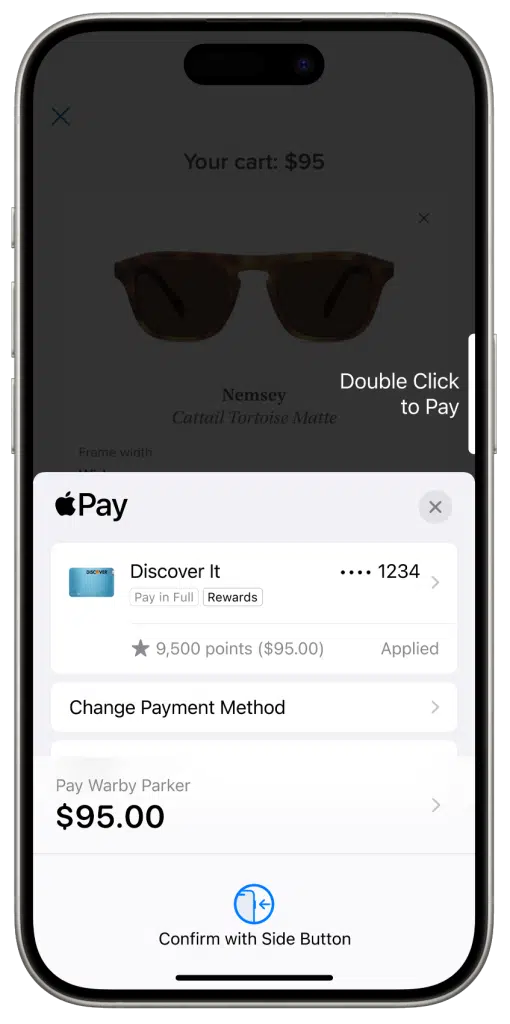

Apple also is adding a way for Apple Pay users to view and redeem rewards and view available installment loan offers from eligible credit and debit cards to iOS18. Rewards redemption for a purchase with Apple Pay will be available beginning in the United States with Discover and Synchrony products and across Apple Pay issuers with the processor Fiserv Inc.

Apple Wallet also will receive updates to how it presents event tickets that will include a map to a venue, in-seat food delivery, and local weather forecasts.