Payables-automation company Tipalti Inc. is partnering with Intercash, a provider of prepaid card solutions, to offer Mastercard-branded prepaid cards in 192 countries, including Latin America and Southeast Asia. Tipalti views the cards, which are available to the general public, as a way for businesses to pay unbanked and underbanked workers …

Read More »Visa And Daimler Plan to Bring Strong Authentication Natively to the Dashboard

Digital payments have been moving to the automobile dashboard for some time, and now the latest development is user authentication. Visa Inc. and the big automaker Daimler AG are planning to launch so-called native in-car payments starting next spring, according to an announcement early Monday. The new capability will replace …

Read More »U.S. Bank’s Bill Pay Tweak and other Digital Transactions News briefs from 11/8/21

U.S. Bank said it added its Request for Payment services to its U.S. Bank eBill Service, enabling the bank’s commercial clients access to an integrated bill delivery and payment platform. The Request for Payment component enables consumers to choose to have their bills delivered directly to them through the bank’s Web …

Read More »Zip Adds a WebBank-Issued Card to Its BNPL Roster

Zip Co. Ltd. launched the Zip Card, a physical card to complement its virtual card in the highly competitive buy now, pay later arena. The new card, to be issued by WebBank, a Salt Lake City-based industrial bank that works with brands like Dell Financial Services, CAN Capital, Klarna, Fingerhut, …

Read More »Small-Business Payments And Disbursements Help Fuel Zelle’s Q3 Growth

Building on its strategy of expanding beyond peer-to-peer payments, Zelle, the P2P network operated by Early Warning Services LLC, processed $127 billion on 466 million transactions during the third quarter of 2021. Overall, the dollar value of payments sent during the quarter increased 51% from the same period a year …

Read More »EVO Revenue up 15.4% and other Digital Transactions News briefs from 11/3/21

Payments provider EVO Payments Inc. reported third-quarter revenue of $135 million, a 15.4% increase from the same quarter in 2020. Fifty-nine percent, or $79.4 million, of its revenue came from the Americas and the remainder, $55.6 million, from EVO’s European business. Net income of $7.1 million for the quarter was down 51.4% …

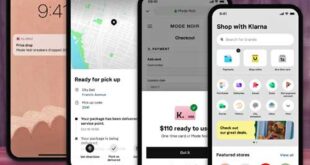

Read More »Klarna Launches a New App That Brings BNPL Capability to Any Online Store

Two trends have buoyed the payments business since the onset of the pandemic—online shopping and buy now, pay later capability—and on Wednesday Klarna AB launched a new app that exploits both trends by letting consumers use Klarna’s BNPL service regardless of whether the store is a Klarna merchant. The new …

Read More »Consumers Intend to Embrace BNPL As Never Before This Holiday Shopping Season

Heading into the holiday shopping season, consumers are poised to make even more use of buy now, pay later options than in the past. Overall, 42% of consumers plan to use BNPL while holiday shopping, according to a survey by GoCardless, a provider of account-to-account payments. When Millennials were asked …

Read More »Global Payments Ramps up While Reporting New Ties to PayPal And Growth in BNPL

The big processor Global Payments Inc. on Tuesday morning reported a busy third quarter that included an expansion of its relationship with PayPal Holdings Inc., ventures in the hot buy now, pay later market, recovery from the pandemic’s impact, and growth in the company’s issuer business stemming from its link …

Read More »Jack Henry’s Zelle Incentive and other Digital Transactions News briefs from 11/2/21

Jack Henry & Associates Inc. and Early Warning Services LLC, the Zelle operator, announced a rebate program through June 2022 for minority-owned depository institutions that enable Zelle via Jack Henry’s JHA PayCenter, its faster payments hub.Prepaid Technologies Co. Inc. said it raised $96 million in its latest funding round that it will use …

Read More »