Two trends have buoyed the payments business since the onset of the pandemic—online shopping and buy now, pay later capability—and on Wednesday Klarna AB launched a new app that exploits both trends by letting consumers use Klarna’s BNPL service regardless of whether the store is a Klarna merchant.

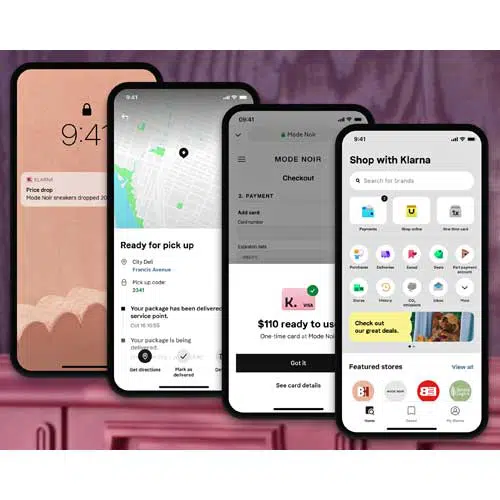

The new app features so-called one-time cards that enable transactions at any online store, Klarna says. With this feature, users press a “pay with K” button on the app to invoke the one-time card at the value of the purchase. They then tick off the pay later option, review the terms, and copy and paste the one-time card into the checkout to complete the transaction. Terms can vary among BNPL providers and stores, but typical terms are four equal payments at no interest over a six-week period.

Other features of the app, which is available for both iOS and Android phones, include so-called curated content keyed to the user’s favorite products and stores, notices of price reductions and what Klarna calls “exclusive deals,” spending reports for monthly budgeting, and delivery tracking.

Other features, including a loyalty program, live shopping events, and data on products, price history, and reviews, are coming, Stockholm-based Klarna says. The company says its existing service is used by 15 million consumers in the United States, and 290 million all told across 17 countries.

“With the introduction of our new app, Klarna becomes an end-to-end shopping service that caters to many needs—from inspiration and discovery to seamless post-purchase experiences,” says Sebastian Siemiatkowski, chief executive of Klarna, in a statement. “Meanwhile, we’ve made transparent and flexible payments a possibility everywhere because we believe no one should ever have to pay credit card fees or high-interest rates.”

BNPL has taken off over the past year as credit-strapped consumers have sought out alternatives to credit cards to finance purchases, especially for e-ecommerce. And, despite the entry of major players such as Square Inc., PayPal Holdings Inc., and Affirm Inc., much potential remains for companies offering the service, some experts say.

The market potential stands at $100 billion, with just $4 billion to $6 billion having been lent so far, according to an estimate offered last week by Rick Cunningham, senior vice president for strategy and business development at Alliance Data Systems Corp., who spoke at the Money20/20 conference in Las Vegas.

The new Klarna app is available in the United States, the United Kingdom, Australia, New Zealand, Germany, and 10 other European countries.