July 20 marks the one-year anniversary of the debut of FedNow, the Federal Reserve’s real-time payment service. It also marks the anniversary of the payments industry letting its breath out in anticipation of the launch. Since then, both FedNow and its fellow faster payments providers have all benefited from the …

Read More »Search Results for:

Aurus To Integrate Paze’s Checkout Tech and other Digital Transactions News briefs from 7/19/24

Payment-processing software provider Aurus Inc. said it will work with Early Warning Services LLC to integrate EWS’s Paze online checkout technology, with Aurus user Wakefern Food Corp. having already adopted Paze. Cash App will leave the United Kingdom market, having launched there in 2018, it announced in a Web post. The service will shut down …

Read More »Faster Payments Leap Ahead As Nacha Sees a 47% Jump in Same-Day ACH Volumes

Since the 2016 launch of same-day automated clearing house payments, the payment type has done nothing but grow. The 2024 second quarter is no exception, with the latest figures showing 292.3 million transactions, a 46.6% increase from 199.4 million in 2023’s second quarter, according to Nacha, which administers the ACH …

Read More »J.D. Power Launches a Certification Program for Mobile App Platforms

J.D. Power announced early Monday the launch of a mobile-banking app certification program. The program is intended to recognize app providers that deliver an exceptional user experience, the company says. The J.D. Power Mobile App Platform Certification-Banking program rates mobile apps using a set of 146 best-practices benchmarks, including app …

Read More »A Panoply of Factors Help Drive Record Volume for the Big Banks’ Real Time Payments Network

The Clearing House Payments Co. LLC reported early Wednesday its 7-year-old RTP service on June 28 exceeded $1 billion in daily volume for the first time. TCH waited a week and a half to disclose the milestone as it worked out what the factors were behind the record-setting performance, only …

Read More »Ticketing And Soft POS Will Drive Contactless Payment Growth, a Forecast Says

Contactless payments are forecasted to surge 113% in value by 2029, reaching $15.7 trillion by 2029, up from $7.4 trillion this year, predicts a new report from Juniper Research. Ticketing and soft point-of-sale applications will be significant drivers of this growth, United Kingdom-based Juniper says. “As access becomes more widespread, …

Read More »Plaid Brings Open-Banking Technology to Western Union in Europe

Open-banking technology provider Plaid Inc. is pairing-up with The Western Union Co. to bring its account-verification services to the wire-transfer giant’s European customers. Under the so-called collaboration San Francisco-based Plaid announced Thursday, Western Union will be able to tap Plaid’s open-banking system for account verification, thereby simplifying remittances and digital …

Read More »Verifone Makes Mashgin Integration and other Digital Transactions News briefs from 5/20/24

Point-of-sale technology provider Verifone will integrate self-checkout technology from Mashgin in its Verifone Commander system at approximately 50,000 convenience stores, said to be roughly 40% of all U.S. c-stores. Zelis, a technology provider for health care, launched its Zelis Advanced Payments Platform to handle claims payments for health insurers. The Western Union …

Read More »Will Its Supreme Court Victory Embolden an Already Activist CFPB?

The Consumer Financial Protection Bureau’s victory at the Supreme Court on Thursday answers for now the question of its constitutionality and may quiet the agency’s critics, who view it as a largely unnecessary agent of federal power operating with an overly aggressive agenda. But some payments experts fear the decision, …

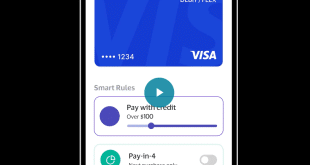

Read More »Visa Revamps its Payments Approach

Visa Inc. is taking up the notion of a digital payment identity and making it part of its product mix. Announced Wednesday at the Visa Payments Forum in San Francisco, the Visa Flexible Credential is but one of several products the payments network formally debuted, including broader tap-to-pay capabilities, a …

Read More »Flywire Widens Invoicing Access and other Digital Transactions News briefs from 5/15/24

Flywire Corp., a specialist in payments for higher education, said it has widened the availability of its third-party invoicing platform, which lets third parties pay tuition and fees on behalf of students. Buy now, pay later provider Afterpay said Gen Z consumers—those born between 1997 and 2012—increased first-quarter 2024 spending at small …

Read More »Behind Open Banking’s Growing Appeal to Consumers, Merchants—And Card Networks

Open banking has been attracting the attention of bankers, merchants, and card networks. It’s also drawing notice from regulators. The concept of making a payment through a direct transfer from a bank account can appeal to consumers because it’s fast and easy, and to merchants because the transaction is reportedly …

Read More »Consumers And Businesses Are Embracing Instant Payments, a Fed Study Says

Consumers and businesses are embracing instant-payment options for such transactions as bill payment, mobile-wallet funding and defunding, account-to-account transfers, and immediate payroll for employees, the Federal Reserve says. A pair of studies surveying businesses and consumers about instant payments and the payments landscape, released late Monday by the Fed, reveals …

Read More »Chase Adds a Pay-Per-Use Real-Time Payments Option for SMBs

Chase, the banking arm of giant JPMorgan Chase & Co., introduced a suite of digital products it says will help small businesses improve their cash flow and payment processing. Among the services are the ability to choose a payment speed, such as standard automated clearing house, same-day ACH, or real-time …

Read More »QuickCharge And Just Walk Out Tech and other Digital Transactions News briefs from 4/25/24

Quickcharge, a division of Transact Campus Inc., completed an integration of Amazon.com Inc.’s Just Walk Technology at St. Joseph’s Hospital in Tampa that enables employees to use their badges to pay for food and beverages. Payments processor Elavon said it is expanding a partnership in Europe with commerce-technology platform FreedomPay to include …

Read More »Time Will Tell on How Soon Pay by Bank Goes Mainstream

Open banking, the ability for third-party developers to access financial data in traditional banking systems, as defined by Stripe Inc., may provide one component for a new payment type, at least one that has limited use today. Pay by bank, a payment method that enables an online payment without the …

Read More »Mastercard’s Real-Time Canada Move and other Digital Transactions News briefs from 4/15/24

Mastercard Inc. said it is working with payments-technology platform VoPay to offer what the partners say will be near-real-time money-movement service in Canada. The service relies on Mastercard Move, a set of funds-transfer options. The Merchants Payment Coalition, which advocates for passage of the Credit Card Competition Act, cited the recent profits …

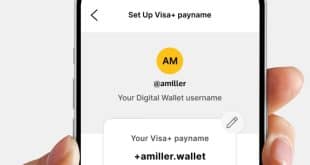

Read More »PayPal And Venmo’s Visa+ Entry Could Aid Interoperable P2P Payments

Enrolling PayPal and Venmo into the Visa+ interoperable peer-to-peer payments system may help foster even more P2P transactions, an analyst says. Visa Inc. earlier this week announced the two P2P wallets from PayPal Holdings Inc. had been enabled in the United States for Visa+. Users can sign up for a …

Read More »Wallets Aren’t Prepaid Cards, Says a Federal Judge in Opposing Fee Disclosure Rules From the CFPB

For the second time, PayPal Holdings Inc. has prevailed against the Consumer Financial Protection Bureau. This time, the case involved the Bureau’s effort to require PayPal to make disclosures regarding its fees associated with digital wallets. U.S. District Judge Richard Leon ruled Friday that wallets are not prepaid cards and …

Read More »PayPal, Venmo Activate Visa+ and other Digital Transactions News briefs from 4/2/24

Visa Inc. announced PayPal and Venmo have activated Visa+, its interoperable peer-to-peer payments service that enables users in one P2P service to make a payment to another person using another network. Fintech Current and The Western Union Co. are expected to enable Visa+ next, Visa said. The service’s B2C payout capability has …

Read More »