Apple Inc.’s newest financial product, a buy now, pay later service called Apple Pay Later, has finally arrived.

Launched Tuesday, Apple Pay Later was announced in June, but only now is it being made available, and just to a limited set of Apple Pay users. Apple says it will offer broader availability in coming months. Apple began inviting the initial users Tuesday.

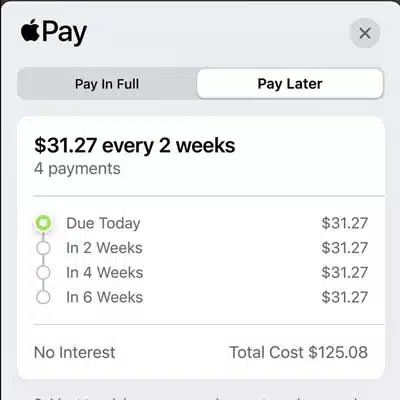

Like many other buy now, pay later services, Apple Pay Later splits purchases into four payments over a six-week period with no interest or fees from Apple. Apple Pay Later loans will range from $50 to $1,000 for online and in-app purchases made on iPhone and iPad at merchants that accept Apple Pay, though Apple says some merchants may not be eligible to offer Apple Pay Later.

To use Apple Pay Later, consumers apply for a loan within the Apple Wallet and enter the amount they wish to borrow. Apple performs a soft credit pull on applicants. Apple is only permitting debit cards as the funding source. “…To help prevent users from taking on more debt to pay back loans, credit cards will not be accepted,” Apple says.

Once approved, the Apple Pay Later installment-payment option will appear when the consumer selects Apple Pay at checkout. Once the BNPL option is set up, the user can apply for a loan directly in the checkout flow of a purchase.

As with Apple Pay, the BNPL transactions will be authenticated with Face ID, Touch ID, or a passcode. Apple Financing LLC, an Apple subsidiary, is backing the loans and will conduct the credit assessment and lending steps. Starting this fall, Apple Financial intends to report Apple Pay Later activity to U.S. credit bureaus.

While Apple’s own backing is important, the strength of Apple in terms of adoption has much to do with its user base, says Sheridan Trent, director of market intelligence at TSG, an Omaha, Neb.-payments advisory formerly known as The Strawhecker Group. They are loyal and open-minded, Trent says. “This group of consumers is quite likely to give Apple Pay Later a try. Further, Apple can use their existing Apple Pay infrastructure to facilitate transactions, making it easy for any users who have ever made a purchase with Apple Pay to now use Apple Pay Later,” Trent tells Digital Transactions News in an email.

Apple’s influence will be felt with this product, says Ariana-Michele Moore, an advisor in the retail banking and payments group at Aite-Novarica Group, a Boston-based financial advisory firm.

“First, it can finance the purchases. Second, it has a significant customer base with a loyal following (ApplePay is one of top wallets out there) and has insight into their customers’ behaviors,” Moore says by email. Additionally Apple Pay is among the top mobile and digital wallets, she says. “Third, this simply provides another option, that many consumers appreciate, within an app that is already installed and widely used. Fourth, it compliments Apple’s credit card offering by offering a product that bridges the world between debit and credit.” And, because Apple Pay Later only works with debit cards, it could have reduced costs from avoiding credit card interchange rates.

Mastercard Inc. is supplying the installment-payment backbone for the service. Because of this, Apple says, merchants that accept Apple Pay need to do nothing else to accept Apple Pay Later. Goldman Sachs Group Inc., the issuer for the Apple Card, is providing the Mastercard payment credential for Apple Pay Later transactions.

Apple Pay Later was anticipated for release in the fall of 2022, but was delayed until now. Apple has not offered an explanation for the postponement. The company also did not disclose merchant fees associated with Apple Pay Later transactions or say whether there will be a separate fee beyond that assessed for accepting Apple Pay. Apple did not immediately respond to questions from Digital Transactions News.

Though Apple may be entering a crowded BNPL arena, there’s potential yet for the payment method. “Retail BNPL still has room to grow too, as eCommerce volume is substantial and will continue to grow,” Trent says. “Another area where BNPL has potential to grow is as a method of payment used in-store–this could be a solid channel for BNPL growth in the future as consumers gain in familiarity with digital wallets and QR codes at physical checkouts.”

Apple’s BNPL competitors include Afterpay, a unit of Block Inc., Affirm Inc., Klarna AB, Sezzle, Splitit, and PayPal’s Pay in 4, among others.

BNPL took off during the pandemic and remains a favorite option for many. “High inflation, tightening credit restrictions, etc. have consumers simply looking for more options,” Moore says. “Many consumers are already familiar with BNPL and it can be a great way for them to manipulate their cash flow when needed.”