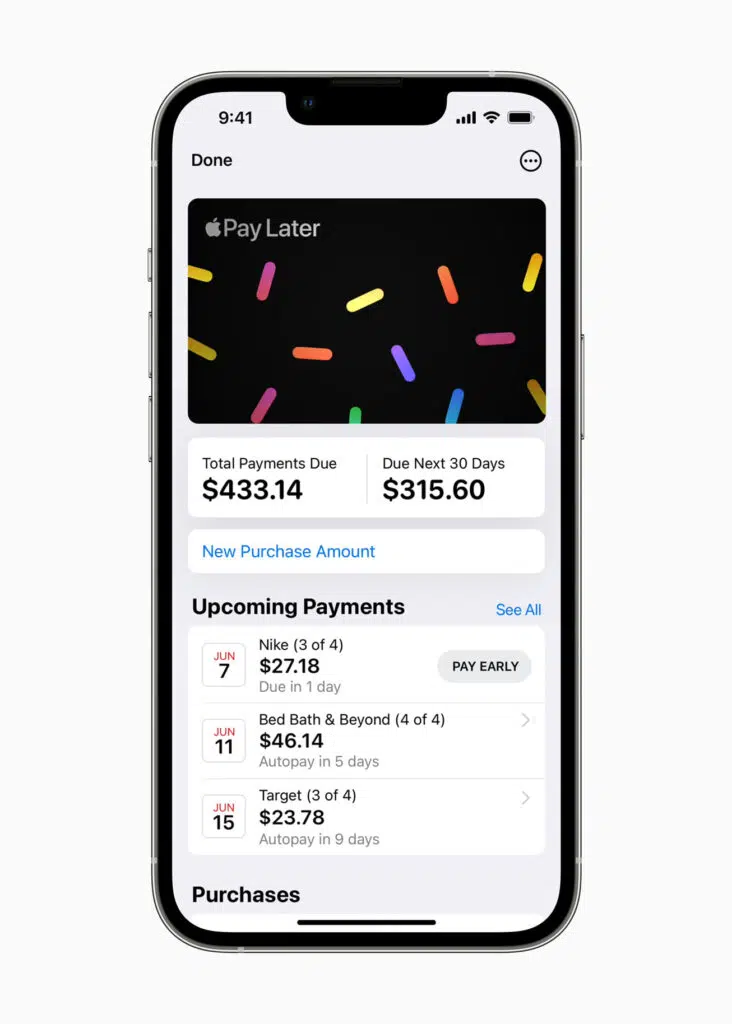

Apple Inc.’s sneak peek at its iOS16 operating system on Monday included the news that the new version will include Apple’s widely expected entry in the hot buy now, pay later market. Available in the U.S. market, Apple Pay Later will be accepted at all places that take Apple Pay online or in-app when the new OS debuts in September, the computing giant said during a presentation of the widely anticipated operating system upgrade. Users can make installment payments via the built-in Apple Wallet.

Apple thus joins a crowded field of BNPL providers that includes formidable rivals such as Affirm Inc. and Afterpay, now part of Block Inc., as well as a slew of smaller players that have emerged in recent years. “We may be at a point where the market is saturated, to the point [Apple] can make existing users happy but where it will be very challenging to draw in new ones,” says Sheridan Trent, a senior research analyst at The Strawhecker Group, an Omaha, Neb.-based payments consultancy.

Apple’s entry also comes at a time when some observers predict rampant inflation, rising interest rates, and squeezed incomes are already pinching consumer budgets, posing a risk of rising defaults.

As with most BNPL propositions, Apple Pay Later lets users divide a purchase into four equal payments over six weeks, with the first installment due at the time of the transaction. No interest applies as long as consumers meet the terms. There are also no fees, Apple says.

Observers say the success of Apple Pay Later in a saturated market will largely depend on Apple’s ability to offer a slick process. “Seamlessness is going to be very critical,” says Trent. “If it flows easily, [Apple] can be a real contender in this space.”

But the difficulty for Apple, Trent adds, goes beyond pleasing current Apple enthusiasts. “The challenge will be drawing in new users,” she says. “If [Apple Pay Later] is well-built, if it’s done right, for the existing base it’ll be just another tool they use, another loyalty generator.”

Another challenge could lie in the intimate link between Apple Pay and Apple Pay Later. “A majority of [Apple Pay Later] transactions are going to come from Apple Pay,” Trent predicts. That’s an inherent advantage for Apple. But, she adds, “a lot of people don’t necessarily set up Apple Pay.”

All in all, Trent says, “we kind of knew this was coming” from Apple. But, for all the slickness of Apple’s technology, she adds, the company’s latest venture is “a little bit complicated.”