For merchants these days, laying hands on a payment terminal with the needed EMV certifications is hard enough. Finding a certified device with built-in intelligence is even harder. Against that backdrop, a Palo Alto, Calif.-based startup called Poynt Co. on Thursday announced its Poynt Smart Terminal is the first such device to be certified for both EMV chip cards and for PIN transaction security under the Payment Card Industry (PCI) data-security rules.

Merchants must have installed and activated EMV terminals by Oct. 1 or assume the risk for counterfeit card transactions in cases where a customer presents an EMV chip card for payment (most EMV cards are being issued with magnetic stripes as well as microchips). But a certification backlog has ensnarled the terminal channel, leaving many retail locations without EMV gear.

That creates a gaping—but temporary—opportunity for new companies like Poynt, which announced its new device a year ago and plans to begin shipments soon. Indeed, with the U.S. move to EMV comes an overturning of the traditional POS terminal base that Poynt hopes to exploit. “Two years ago, we saw the EMV mandate as the only window possible to make this happen,” Poynt chief executive Osama Bedier, a former head of Google Inc.’s Google Wallet mobile-payments service, tells Digital Transactions News. “Even the best ideas will fail if you get the timing wrong.”

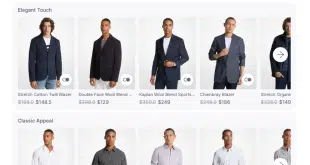

Not that the Poynt device, which runs on a derivative of Android and features an “L” shape that lets it display screens simultaneously to both cashier and customer, is certified for EMV with every processor in the country. For now, Poynt has an integration with CreditCall, a transaction gateway with long EMV experience in Europe, that allows is to reach more than a dozen acquirers. “That frees us from having to do a certification with every acquirer,” says Bedier. “The biggest acquirers out there we will integrate to directly.”

Poynt also has distribution agreements with processors Chase Paymentech, EVO Payments International, POS Portal, and Vantiv. Bedier says he doesn’t plan to add more distributors for a while. “I want to give [the four processors] an advantage,” he says. “They bet on us early.” Poynt’s suggested price on the terminal, which is manufactured in China, is $299, but Bedier says there’s leeway for distributors to price it up to $499.

The device is supported by a developers’ platform and runs apps that can be bundled, or “curated,” as Bedier puts it, for each merchant. “Apps are a big part of the play,” he says. “We think third-party apps will be a big part of it.”

Poynt has also paid attention to its hardware. The device supports transactions by mag-stripe or EMV, near-field communication, barcode, and beacon. Since the prototype’s emergence last year, the company has hardened its case, allowing it to withstand 19 falls from a height of one meter (almost three-and-a-third feet) before failing, Bedier says.

Bedier, who launched Google Wallet in 2011 and left the company two years later, says the idea for a “smart” terminal took root while he was trying to fulfill the mobile-payments service’s promise of a quick, effortless transaction combining payment with loyalty and offers. The existing terminal base, he says, “was nowhere near capable of performing the transaction in a pleasant way.” The answer is a smart terminal to rival the intelligence built into the smart phone most consumers now carry, Bedier says.

Rick Oglesby, a senior analyst at Double Diamond Research, Centennial, Colo., says Poynt’s certifications are a big edge for the fledgling company. “At the moment, there is a limited set of EMV-certified solutions available to merchants,” he says via email. “That’s the key undercurrent in the market that will be driving merchants to seek out new payment devices, so having the certification gives Poynt credibility at the outset of the conversation.”

The new device is also “able to solve problems for merchants and merchant-service providers at the same time, which is a critical combination,” Oglesby adds.

Also on Thursday, Poynt announced a $28-million Series B round of funding, bringing its total funding to $32 million. The round was led by Greenwich, Conn.-based venture fund Oak HC/FT, whose managing partner, Ann Lamont, will joint Poynt’s board of directors.