With cash back as a favored consumer reward, PayPal Holdings Inc. is broadening its use with the debut of PayPal Everywhere, a rewards program for consumers on the PayPal Debit Mastercard.

Announced Thursday, the program includes stackable cash-back offers and personalized ways to manage spending. It enables PayPal Debit cardholders to receive 5% cash back on up to $1,000 in selected category spend per month. Cardholders also can stack these rewards when using offers in the PayPal app from brands including Sephora, Domino’s, DoorDash, Instacart, and PetSmart. If a customer selects restaurant as her monthly category, she’ll receive 5% and another 10% cash back if she saves a deal from DoorDash in the PayPal app.

Cash back offers have replaced miles and similar rewards as the top credit card perk, a recent J.D. Power U.S. Credit Card Satisfaction Study found.

“With rising costs of living, consumers are looking for more ways to save and earn rewards and cash back,” a PayPal spokesperson says. “A new YouGov/PayPal survey shows that 72% of adults would be more likely to use a debit card if it offered generous cash back, and more than half of Gen Z and Millennials say the only thing keeping them from using a debit card is the lack of rewards.”

“Rich cash back has not historically been available on debit cards,” the spokesperson adds, “and we’re really excited to expand choice and flexibility to our customers so they can shop in the way that best suits them while still having access to rewards and the security which PayPal is known for.”

Issuers have historically offered few rewards programs supporting debit cards, in part because the cards are less lucrative for issuers than credit cards. Some banking advocates also argue that the Durbin Amendment to the Dodd-Frank Act dampened banking interest in rewards for debit cards when it became law a decade ago because its cap on interchange left issuers with less revenue to support rewards. Merchant advocacy groups, however, dispute that contention, arguing such programs were always few in number, while some issuers are now offering rewards in the form of cash back.

PayPal’s debit card is issued by The Bancorp Bank, which has approximately $8 billion in assets, according to Ted Rossman, senior industry analyst at Bankrate.com.

“So that’s most of the answer—they can charge higher debit interchange fees than big banks such as Chase, Bank of America and Citi, so they’re willing to share some of that windfall with customers in the form of rewards as an incentive to use their cards,” Rossman says in an email to Digital Transactions News.

“The other thing I’ll point out,” he adds, “is that while 5% debit rewards are very generous, that rate only applies to one spending category and is capped at $1,000 in monthly spending. There are some other merchant-specific rewards, but most transactions still won’t earn rewards. So, while consumers can still benefit from this, it’s pretty niche. It’s not like they’re getting 5% back on everything they buy,” he says.

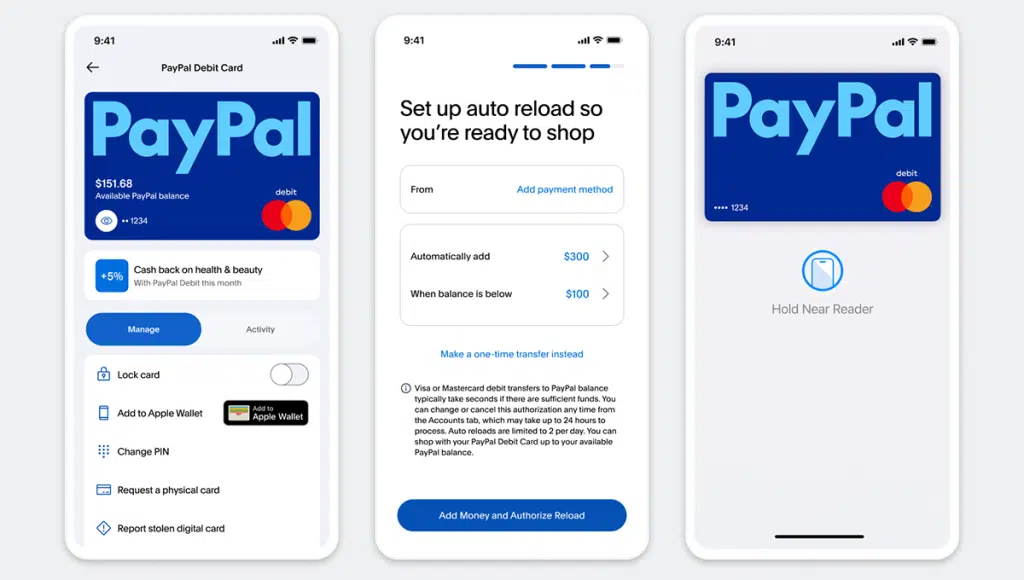

Other elements of PayPal Everywhere includes an auto-reload function to maintain a balance with PayPal, tap-to-pay convenience, and a simpler enrollment process.

PayPal also says the process to add the PayPal Debit card to Apple Wallet has fewer steps than was the case previously.