Digital wallets continue to find a foothold in payments. The latest entry is BMO Commercial Bank’s debut of Extend, a virtual card service for its app. And startup Tezro launched a digital wallet aimed at integrating banking, payments, and shopping through messaging apps consumers already use.

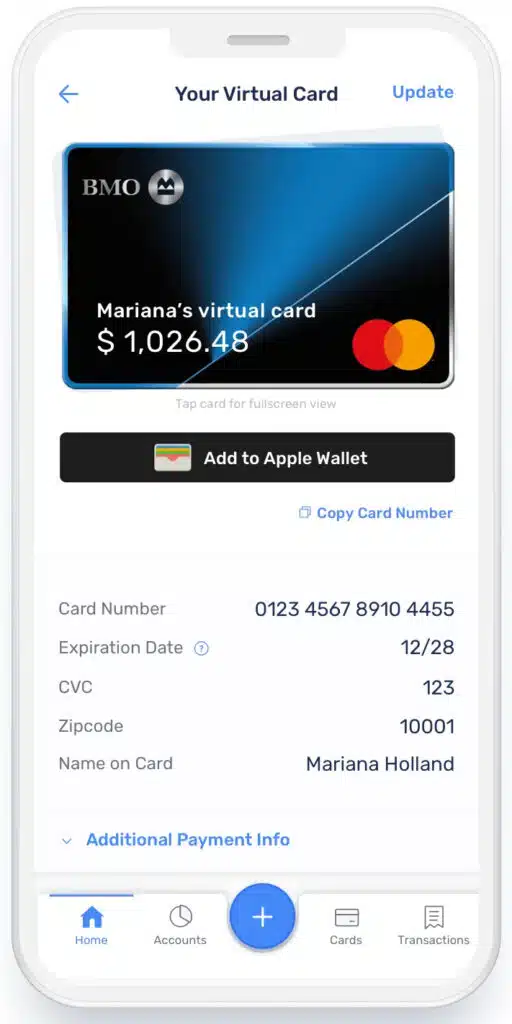

BMO Commercial Bank, a part of BMO Financial Group, says Extend enables its cardholders to create and push a virtual card to their employees’ mobile wallets, enabling them to spend wherever contactless payments are accepted.

A Mastercard Inc. issuer, BMO says Extend makes it easier for its corporate card clients to manage travel and business expenses more easily. The service has spending controls and receipt and reconciliation processes.

By enabling the loading of a virtual card to an employee’s mobile wallet, clients can capture more business-related expenses, that, for example, may have been made with cash. “People expect to be able to make payments on the go, even when those payments are for business expenses,” Andrew Jamison, Extend Enterprises Inc. chief executive and cofounder, says in a statement. New York City-based Extend was founded in 2017.

BMO says Extend can be integrated into an existing BMO corporate card program in as little as five minutes.

Digital wallet provider Tezro, based in Lithuania with an office in New York City, says its integrated banking, payments, and shopping platform is in a testing stage. Among its features are chat payments, escrow services, digital payment cards, and livestream shopping.