The Western Union Co. says its decision to join the early set of providers in Visa Inc.’s interoperable peer-to-peer payments service called Visa+ reflects its business. Visa+ allows users to move payments between rival peer-to-peer payments networks. The pilot, set to launch later this year, will begin with transfers between …

Read More »Rev Worldwide Closes Netspend Deal And Other Digital Transactions News briefs from 5/1/23

Working with Searchlight Capital Partners, payments provider Rev Worldwide closed on its $1-billion all-cash acquisition of the Netspend consumer business from Global Payments Inc. Netspend is a specialist in prepaid and debit cards for more than 100,000 retail locations. Payments provider Finix Payments Inc. said it is now a payment processor, having completed direct connections to …

Read More »The Addition of Citi Flex Pay To Amazon Pay Could Be a Winner For Amazon and Citibank

Amazon.com Inc.’s deal with Citibank N.A. to add Citi Flex Pay, the card issuer’s installment-loan program, to its Amazon Pay digital wallet is expected to pay big dividends for both parties. By adding Citi Flex Pay, Amazon Pay will gain access to one of the largest cardholder bases in the …

Read More »Amazon’s Cobranded Card Revenue up And Other Digital Transactions News briefs from 4/28/23

Amazon.com Inc. reported first-quarter revenue from “other sources” of $1.03 billion, up 55% year-over-year. The “other” category includes revenue from the massive online retailer’s cobranded credit cards. Total revenue from products and services for the quarter was $127.4 billion, up 9.5% year-over-year. Law firm BakerHostetler released its 2023 Data Security Incident Response …

Read More »Shopify Strives To Reduce False Positives And Increase Customer Acquisition

Vesta, a transaction-guarantee platform for online purchases, has partnered with e-commerce platform provider Shopify Inc. to make its fraud-fighting solutions available to Shopify merchants. The addition of Vesta is expected to help Shopify sellers in the United States, Canada, and Mexico reduce false positives and increase approval rates for legitimate …

Read More »FIS Profit up 17.5% And Other Digital Transactions News briefs from 4/27/23

Payment processor and core banking provider FIS Inc. posted first quarter revenue of $3.51 billion, a 0.6% increase from $3.49 billion in the same quarter in 2022. Its net income of $141 million was 17.5% greater than the $120 million profit a year ago. FIS’s merchant solutions segment had revenue of $1.1 …

Read More »Dwolla Expands Partner Ecosystem 45% in Q1

Citing increased demand for low-cost account-to-account payment solutions, digital-payments fintech Dwolla Inc. announced it grew its partner ecosystem 45% during the first quarter of 2023, bringing the total number of partners to 40. Among the companies to partner with Des Moines, Iowa-based Dwolla is financial data aggregator Flinks, a Montreal-based …

Read More »Visa Credit Card Volume up 5.2% And Other Digital Transactions News briefs from 4/26/23

Visa Inc.’s U.S. debit card payments volume of $767 billion in its fiscal second quarter increased 9.6% from $699 billion in the quarter ending March 31 a year ago. Its U.S. credit card payments volume of $704 billion was a 10.5% increase from $638 billion a year ago. For all regions, Visa’s …

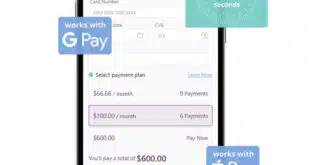

Read More »Eye on BNPL: Splitit Speeds Checkout; Klarna Introduces Personal Shopping Feed

White-label buy now, pay later provider Splitit Payments Ltd., introduced on Tuesday SplititExpress, a checkout experience that enables consumers to complete checkout in less than two seconds, compared to one-to-two minutes for other BNPL applications, Splitit says. The new feature also supports installment payments via Google Pay and Apple Pay. …

Read More »Ingenico Releases App Tool And Other Digital Transactions News briefs from 4/25/23

Payments-technology provider Ingenico launched its AXIUM Payment Experience, dubbed APEX, an app intended to make it easier for businesses to craft payments apps. U.S. payments provider InComm Payments introduced a new unit, InComm Payments Brazil Technology Ltda., to expand the company’s operations in Brazil. Embedded-finance specialist Maast launched a set of new technologies aimed at making …

Read More »