ParkMobile LLC, a provider of mobile parking payments, said it has reached 18 million users after a 110% two-year growth rate. It also said it has appointed John Brown chief operations officer. Brown previously held executive positions at Clutch Technologies, Cardlytics, and Fiserv Inc.Payment card provider CPI Card Group Inc. announced its …

Read More »Survey: Americans Have $21 Billion in Unused Gift Card Balances

All those unredeemed gift cards in people’s drawers and on dresser tops are adding up. New research from Bankrate LLC estimates the total value of Americans’ unredeemed gift cards and leftover store credits at $21 billion. Bankrate says its survey, the firm’s first of its kind, found the average adult …

Read More »Fiserv Tests PIN-on-Mobile and other Digital Transactions News briefs from 2/18/20

Fiserv Inc. said its First Data unit is piloting PIN-on-mobile technology in Poland, with plans to expand the program to the rest of Europe, the Middle East, Africa, and the Asia-Pacific region. The technology, which allows merchants to accept PINs on off-the-shelf mobile devices, was developed in collaboration with Visa Inc., Samsung Electronics …

Read More »Chargebacks911’s Tips on BOPUS Fraud and other Digital Transactions News briefs from 2/17/20

Chargebacks911 released a set of tips for retailers about managing buy-online, pickup-in store fraud.VersaPay Corp., a provider of electronic invoice presentment and payment, said its shareholders overwhelmingly approved acquisition of all outstanding common shares by 1233518 B.C. Ltd., an affiliate of private-equity firm Great Hill Partners. Shareholders will receive $2.70 Canadian …

Read More »Checks’ Last Bastions Include Older Consumers, Businesses, and Bill Payments

The decline of checks over recent decades is a well-known story, but there were still 14.5 billion check payments in 2018, according to Federal Reserve research. So just who’s still writing checks, and for what kinds of payments? “All things being equal, older, low-income, non-minority group members are more likely …

Read More »RILA Calls for Action on the Fed’s Debit Cap As Powell Testifies Before Congress

Federal Reserve Board chairman Jerome Powell is testifying before Congress this week, and mixed in with questions and answers about interest rates, economic growth, and employment could be queries about when the Fed is going to update its cap on the fees issuers can charge for debit card transactions. At …

Read More »Eye on Fintechs: Sezzle Sizzles With 1 Million Users and Curve Opens a U.S. Office

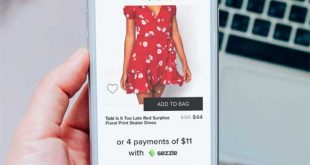

Buy-now-pay-later specialist Sezzle Inc. said it surpassed 1 million consumers using its online payment service. Launched in 2016, Sezzle said it had reached 500,000 customers only in August 2019. At the end of the fourth quarter, the company, with corporate headquarters in Australia, said more than 10,000 merchants offer its …

Read More »Nacha Is Building Phixius, a Trusted Conduit for Payment-Related Information

A platform to help ensure payments are made to the proper entity is preparing for a May debut. Dubbed Phixius, the Nacha-developed platform will provide a way to enable the secure sharing of payment-related information. That’s important because the platform, announced this week, could save businesses time in vetting new …

Read More »Report: Changes in Visa’s Interchange Rate Schedule Coming This Year

Visa Inc. reportedly is planning interchange rate changes that could raise merchants’ acceptance costs for card-not-present transactions but lower costs in some other categories, including purchases at big grocery-store chains. Citing a Visa document circulating among the network’s client banks, the Bloomberg news service reported Tuesday that interchange for a …

Read More »ACH Transactions Rose 8% in 2019 While Payment Value Increased 9%

The value of payments on the automated clearing house network grew by more than $1 trillion in 2019 for the seventh straight year and transactions increased by more than 1 billion for the fifth consecutive year, ACH governing body Nacha reported Monday. Total payments came to 24.7 billion transactions, up …

Read More »