Corporations aren’t in business to please Wall Street, but for publicly held companies investor expectations are hard to ignore. Affirm Inc. early Friday is seeing its share price climb steadily after exceeding analysts’ consensus expectations for payment volume and revenue for its fiscal third quarter, ended March 31. The good …

Read More »Kickfin Enlists Visa Direct for Tip Payouts and other Digital Transactions News briefs from 5/13/22

Kickfin, a tip disbursement provider, said its tie-in with Visa Direct, the card brand’s push payment service, will enable its clients to send cashless tip payouts directly to employees’ existing bank accounts via eligible debit cards.Buy now, pay later provider Affirm Inc. announced a multi-year extension of its agreement to provide installment-payment …

Read More »Checkout.com To Acquire ID Firm ubble and other Digital Transactions News briefs from 5/12/22

Payments provider Checkout.com has agreed to acquire ubble, a provider of identity-verification technology, in a transaction set to close later this year. Terms were not disclosed.The March 18 increase in the same-day limit to $1 million helped lift same-day ACH volume in the first quarter to $290.3 billion, up 53.3% year-over-year, Nacha said. Transactions …

Read More »Priority’s Revenue up 35% and other Digital Transactions News briefs from 5/11/22

Payments provider Priority Technology Holdings Inc. reported first-quarter revenue of $153.2 million, up 35% year-over-year.PayBright said it will provide installment payments to passengers using CheapOair.ca, an online travel agency.Travel platform Agoda said it now offers interest-free credit card installment payments on its booking platform in a partnership with Visa Inc.E-commerce fraud protection provider Signifyd said it …

Read More »An Appetite for Faster Payments Grows as the ACH Payment Limit Expands to $1 Million

While the payments industry reckons with the arrival of real-time settlement capability, an appetite among financial institutions for faster payments in general has clearly emerged. Dollar volume on the automated clearing house network for transactions settled on the same day grew 53% in March compared to February, following the introduction …

Read More »Fiserv Adds Loyalty Option and other Digital Transactions News briefs from 5/9/22

Large retailers that use Fiserv Inc. payments-acceptance technology can add loyalty functions via a new agreement between Fiserv and loyalty-technology provider Exchange Solutions.The global standards body EMVCo said it is developing an EMV Contactless Kernel Specification for contactless payment acceptance around the world. The new specification will take the place of the more than …

Read More »Stripe Launches Financial Connections, Opening the Door Wider to Open Banking

The big payments fintech Stripe Inc. extended its reach into the world of open banking late on Wednesday with the launch of Stripe Financial Connections, an application that allows businesses to establish direct connections with their customers’ bank accounts. The new application will enable businesses to verify accounts for payments …

Read More »Nettlesome Chargebacks Prove Vulnerable to Mitigation Efforts, a Report Finds

There’s a bit of apparent good news when it comes to chargebacks. The chargeback-to-transaction ratio decreased from 1.94% in 2020 to 1.52% in 2021, and is also down from the remarkable 3.76% seen in 2017. That’s according to the fourth annual “The Year in Chargebacks Report” from Midigator LLC, a …

Read More »Behind The Clearing House’s Effort to Bring Tokenization to Its Real Time And ACH Services

Against a background of emerging real-time payments and steady growth in automated clearing house transactions, The Clearing House Payments Co. LLC is working to mask those transfers with a technology the payment card business has used for years—tokenization. The job is enormous. “We’re just starting—it’s going to take time,” says …

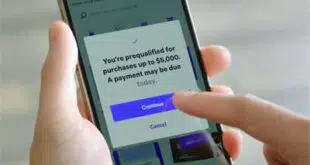

Read More »Fiserv Adds Affirm BNPL to Carat and other Digital Transactions News briefs from 5/4/22

Processor Fiserv Inc. announced it is adding buy now, pay later services from Affirm Inc. to its Carat operating system. Affirm joins Bread, Synchrony, and Zip as current providers. Affirm said its service will be the first fully-integrated BNPL provider with Carat.Payments provider Rapyd Financial Networks Ltd. launched Virtual Accounts, intended to allow businesses anywhere globally …

Read More »