Personalized financial-management tools and digital assistants will provide the pathway for banks and card issuers to differentiate their mobile apps or Web sites from those of competitors and drive adoption and usage, according to a new report from J.D. Power. The best opportunities for card issuers will come from offering …

Read More »Merchants Get an Extension to File Monetary Claims in the Big Credit Card Settlement

Merchants have been granted a 90-day extension to file a monetary claim as part of the settlement of a nearly two-decades-old interchange lawsuit filed against Visa and Mastercard. Merchants now have until Aug. 30 to file their claims, the court overseeing the settlement has ruled. A settlement between Visa and …

Read More »The MPC Fires Back at Claims Merchants Won’t Pass Along CCCA Savings to Consumers

Claims by banks that merchants won’t pass along savings from the Credit Card Competition Act to consumers are grossly misleading and do not reflect the economic realities merchants face, argues the Merchants Payments Coalition, a lobbying group representing sellers on payments-acceptance matters. Passing along cost savings or at least holding …

Read More »Google Pay Updates and other Digital Transactions News briefs from 5/22/24

Google launched new features for Google Pay, including rewards for American Express and Capital One transactions, an expansion of buy now, pay later options, including Affirm and Zip, and automatic fill-in of full card details. Processor FIS Inc. launched FIS Digital One Flex Mobile 6.0, an update to its mobile-banking app, with what the …

Read More »Why Banks Say Sellers Are Unlikely To Pass Savings From the CCCA on to Consumers

Despite some claims to the contrary, the odds are long that merchants would pass on any potential savings to consumers from the Credit Card Competition Act, payments experts say. One argument for this is that merchants price products on a line-item basis, which means the savings on a single product …

Read More »Revenue Down 33% and other Digital Transactions News briefs from 5/21/24

Presto Automation Inc., a provider of payments technology for quick-serve restaurants, said its March-quarter revenue dropped 33% year-over-year to $4.45 million. Revenue for the year ending March 31 also fell by one-third, to $14.2 million. The company said it will wind down its pay-at-table product to concentrate on its artificial-intelligence …

Read More »Will Its Supreme Court Victory Embolden an Already Activist CFPB?

The Consumer Financial Protection Bureau’s victory at the Supreme Court on Thursday answers for now the question of its constitutionality and may quiet the agency’s critics, who view it as a largely unnecessary agent of federal power operating with an overly aggressive agenda. But some payments experts fear the decision, …

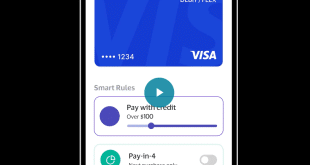

Read More »Visa Revamps its Payments Approach

Visa Inc. is taking up the notion of a digital payment identity and making it part of its product mix. Announced Wednesday at the Visa Payments Forum in San Francisco, the Visa Flexible Credential is but one of several products the payments network formally debuted, including broader tap-to-pay capabilities, a …

Read More »Supreme Court Upholds CFPB Funding and other Digital Transactions News briefs from 5/16/24

The U.S. Supreme Court early Thursday upheld the constitutionality of the Consumer Financial Protection Bureau by a 7-2 vote, reversing an October 2022 ruling by a federal appeals court in New Orleans that had held the means by which the bureau is funded violates the U.S. Constitution. The CFPB, created in 2008, receives its …

Read More »Eye on ISVs: Booksy Adds Tap to Pay on iPhone; Usio Could See $20 Million in Revenue From a Single ISV

With an eye to making it easier for consumers to pay how they want, Booksy Inc., a booking platform for beauty-service appointments, is adding Tap to Pay on iPhone as an option. The contactless payment method enables consumers to use their contactless credit or debit cards, or an iPhone with …

Read More »