Tap-to-pay technology for ordinary smart phones is a relatively recent development, but payments companies aren’t wasting any time offering it as it spreads into new countries. The latest example comes from Canada, which became the latest market expansion Thursday for Apple Inc.’s tap to pay on iPhone technology. The first …

Read More »Atomic Looks to Ease the Subscription Economy for Consumers Via a New App That Works Inside Banks’ Apps

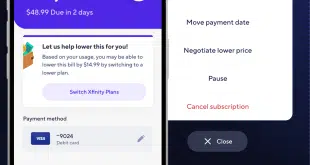

Recurring payments like subscriptions have been gaining increasing attention as more businesses supplement one-off sales and as banks and billers look for ways to automate the process for consumers within their own apps. Now the capability to make and control recurring payments is coming to consumers on their mobile phones. …

Read More »Will Its Supreme Court Victory Embolden an Already Activist CFPB?

The Consumer Financial Protection Bureau’s victory at the Supreme Court on Thursday answers for now the question of its constitutionality and may quiet the agency’s critics, who view it as a largely unnecessary agent of federal power operating with an overly aggressive agenda. But some payments experts fear the decision, …

Read More »Results Improve for Paysafe As the Processor Looks to Beef up Its Internal Sales Staff

Paysafe Ltd. wants to do more to sign merchants directly, and to that end it’s hiring salespeople—lots of them. The London-based merchant processor, which has a big operation in North America and aspirations for a larger one, hired 55 salespeople in the first quarter and plans to add 170 in …

Read More »Growth in Payments Helps Boost Middle-Market Processors, Too

Payments processors haven’t had it easy in recent years, what with a pandemic-led shift to e-commerce on the part of brick-and-mortar merchants, a deluge of new and more complicated point-of-sale technologies, and growth by industry giants like Fiserv Inc. and Global Payments Inc. But many of the midsize players grew, …

Read More »Behind Open Banking’s Growing Appeal to Consumers, Merchants—And Card Networks

Open banking has been attracting the attention of bankers, merchants, and card networks. It’s also drawing notice from regulators. The concept of making a payment through a direct transfer from a bank account can appeal to consumers because it’s fast and easy, and to merchants because the transaction is reportedly …

Read More »The Clearing House Gets Set to Broaden the Reach for Its Request for Payment Service

The U.S. payments industry has celebrated the emergence in recent years of two major platforms for real-time payments, but what has insiders particularly excited is the potential for something called the request for payment, or the RFP, as they style it. “The RFP is the first real shift in how …

Read More »Shrugging off Volatility, Crypto Enthusiasts Hike First Quarter Spending by 20%

When cryptocurrency prices rise, spending may dip, but only for a short time before users accelerate their purchases with Bitcoin and other digital coins, according to a report released Thursday by BitPay Inc., an Atlanta-based payments-service provider for crypto users and crypto-accepting merchants. The ”2024 BitPay Spending Report,” which covers …

Read More »A Year After Closing, Global Begins to Reap Returns on Its $4 Billion EVO Deal

The top management at Global Payments Inc. said early Wednesday the company is beginning to reap the benefits it planned for when it paid $4 billion to acquire EVO Payments Inc., a processor with international merchant connections. The deal, which is now more than a year past its closing date, …

Read More »Swallowing Discover Will Energize Competition, Not Restrict It, Cap One’s CEO Argues

Capital One Corp.’s chief executive late Thursday struck back against concerns that the banking giant’s proposed acquisition of Discover Financial Services will dampen competition in banking and payments. “The facts will show there are no barriers to entry in the credit card business,” declared Richard Fairbank as he fielded questions …

Read More »