The buy now, pay later trend is getting hotter with the summer. PayPal Holdings Inc. announced early Wednesday it will offer a plan allowing consumers to split large purchases over a period of six to 24 months. The monthly payments will incur interest and will apply to transactions valued between $199 and $10,000, PayPal said.

The new plan, dubbed Pay Monthly, comes on top of PayPal’s existing Pay in 4 product, which features the common BNPL requirement of four payments split over a relatively short period, commonly six weeks, with no interest. Some 22 million PayPal users tapped into that product over the past year, PayPal says. The new service also comes at a time when inflation is driving up prices and interest rates are climbing, increasing risk for some consumers and providers, some observers say. And it follows by a week Apple Inc.’s launch of Apple Pay Later, a BNPL service the computing giant is self-funding.

PayPal said its new service will be available to “millions of merchants” at “no additional cost or risk.” As with the Pay in 4 plan, merchants can use messaging to notify customers of the new product’s availability. BNPL options are typically available for online purchases, but some have migrated to physical stores. The new service is available at “millions of retailers,” PayPal says.

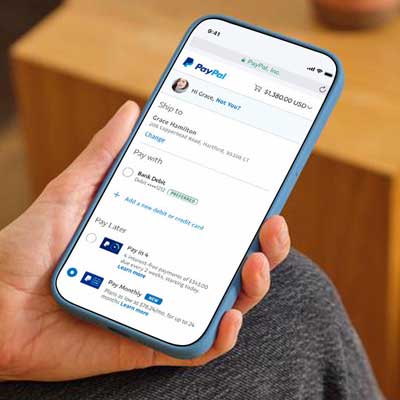

PayPal cites recent consumer research as part of its rationale for the bigger BNPL plan. Some 65% of U.S. consumers are saving to make large purchases, while 79% are trying to map out and keep to a budget, the company says. As with Pay in 4, the new service carries no late fees. Repayment with the new service flows through a debit card or bank account, while users can track activity on the PayPal app.

“How consumers look to pay for larger purchases is evolving and there is a growing demand for flexible payment options,” said Greg Lisiewski, vice president of shopping and pay later at PayPal, in a statement. “Pay Monthly builds on our commitment to deliver leading payment solutions that offer customers choice to ensure checkout matches their needs and budgeting preferences.”

The latest move by PayPal in installment lending at the point of sale comes at a time when some players are pushing the service into higher-ticket purchases. But some executives caution that the cost base of the technology and of funding means the service works best with single big-ticket expenses, such as medical bills or home-improvement costs, rather than retail purchases.

“You have to have massive scale if you’re financing T-shirts and tennis shoes,” notes Brian Shniderman, U.S. chief executive for OPY USA Inc., a unit of Australia-based BNPL player OpenPay Pty. Ltd., who spoke to Digital Transactions for an upcoming story on trends in BNPL.

While not addressing any particular BNPL product, Shniderman cautions that the new environment of rising inflation and interest rates will reshape the business. “We’re going to see a big reset in BNPL,” he notes. “You’ll see some consolidation, and some [players] will go out of business.”