Block Inc., parent company of Square Inc., has become the latest payments provider to come under the scrutiny of the Consumer Financial Protection Bureau. The CFPB, as well as attorneys general from multiple states, have requested information from Block related to how the company handles complaints and disputes from customers using its Cash App wallet. The investigation was disclosed as part of a recent regulatory filing, according to Bloomberg News.

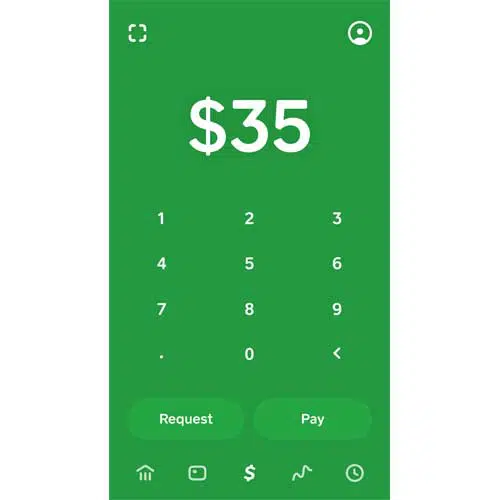

Cash App is a mobile-payment service that allows users to transfer money to one another using a mobile phone app. Cash App users can also or buy stocks and Bitcoin directly from their phone. The service is available in the United States and the United Kingdom. Block chief financial officer Amrita Ahuja told equity analysts in an earning call last month that

Cash App is generating a 22% annual growth rate and has 44 million monthly active users. In September 2021, the service reportedly had generated $1.8 billion in gross profit.

Block is reportedly cooperating with the CFPB and the state attorneys general.

In a recent 10-K filing with the Securities and Exchange Commission for the year ended December 31, 2021, Block says investigations by regulatory agencies are not uncommon.

“Various regulatory agencies in the United States and elsewhere in our international markets continue to examine a wide variety of issues that could impact our business, including products liability, import and export compliance, accessibility for the disabled, insurance, marketing, privacy, data protection, information security, and labor and employment matters,” the company says in in the filing. “As our business continues to develop and expand, additional rules and regulations may become relevant.”

In addition, the company says it is not possible to reliably determine the potential liability stemming from the investigation, according to the Bloomberg report.

Block could not be reached for comment.

The latest action by the CFPB comes as the agency has been stepping up its investigation of payments players. It has been actively investigating providers of buy now pay later services, including Afterpay Ltd., which Block acquired in January. The acquisition of Afterpay creates an opportunity for Block to more tightly integrate its seller and consumer businesses, Square and Cash App, the company says.