At the helm of Deluxe Corp. since 2018, Barry McCarthy is seeing a payoff from the company’s shift from paper-based to electronic payments.

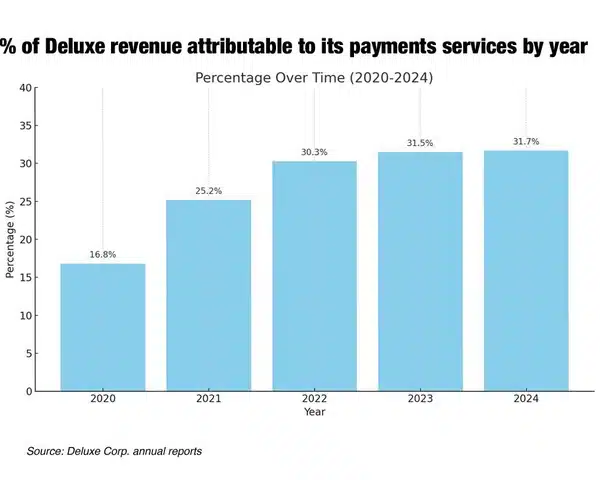

Minneapolis-based Deluxe, which posted $2.1 billion in 2024 revenue, has seen its percentage of overall revenue attributed to its payments services, which includes merchant services and business-to-business payments endeavors, increase from 16.8% in 2020 to 31.7% in 2024. In 2020, its payments revenue came from treasury management and similar corporate payment services, like payroll and disbursements.

McCarthy is president and chief executive of the venerable payments company, once best known for printing checks. Checks have declined among some users, though they remain particularly popular in the B2B payments segment. Still, the portion of Deluxe’s overall revenue coming from check printing has decreased from 39.4% in 2020 to 33.1% in 2024. The Federal Reserve, in its most recent Payments Study with data from 2021, says the total number of checks paid was 11.1 billion, down from 13.6 billion in 2018.

McCarthy, a former First Data, now Fiserv, and Wells Fargo executive, says Deluxe is transforming from a paper-payments company and becoming a digital payments one. The big boost in that plan was the 2021 acquisition of First American Payment Systems LP, a processor with 159,000 merchants that had relationships with independent sales organizations and independent software vendors.

That acquisition fundamentally changed Deluxe and continues to do so, McCarthy says. “It goes back to the core strategy, trying to move the company from a paper-payment type to digital-payment types,” McCarthy tells Digital Transactions News. Not only was First American Payment immediately adjacent to Deluxe’s financial-service business lines, it also had the ability to move and manage at scale, he says. Having the ability to process payments is important, but so too was the accompanying ability to scale that ability, he says.

“We went to the market specifically to buy a company that is a processor,” McCarthy says. “We did not want to become an ISO. We want to run the infrastructure for payments.” First American Payment met Deluxe’s criteria because it was a processor, its technology could be scaled, and it came with a management team that was knowledgeable and respected, he says.

With that acquisition in place, the push into merchant services was in force. In addition to traditional merchant acquisition and partnerships with ISOs and ISVs, Deluxe also takes advantage of its relationships with financial institutions, of which McCarthy says Deluxe serves more than 4,000.

The First American Payment acquisition gave Deluxe access to the community banks working with the processor, something McCarthy and crew have expanded on by offering merchant services to regional banks. In April, Deluxe said TowneBank, a Suffolk, Va.-based bank, would work with Deluxe to offer its merchant services to the bank’s clients.

When asked about the potential for additional partnerships during the Deluxe first-quarter earnings call on April 30, McCarthy said, “First, the Deluxe brand, the reach that our company has, and the large number of financial institutions that already are doing business with us gives us a very, very large scale opportunity to build new partnerships in the bank channel specifically.” Secondly, as McCarthy tells Digital Transactions News, Deluxe can talk to them about how they can serve their clients better than some of the larger providers, which Deluxe is winning business from.

Deluxe is counting on its ability to offer a variety of payments and related services to attract and retain customers, too. In addition to check printing, merchant services, and B2B payments, Deluxe offers marketing services that use data and analytics for B2B and business-to-consumer marketing.

“We help financial institutions and others find high-value, lifetime customers,” McCarthy says. That effort could include helping a bank market to high-net-worth individuals or an online retailer trying to reach consumers in the physical world, he says. It can be expensive to acquire these consumers who have longevity with a company, he says, adding, “In order to do that, they need to be targeted.”

Deluxe aggregates data from more than 100 sources to help identify these individuals and uses artificial-intelligence tools to help narrow down the list. “They work because of their high conversion rate,” he says of the data services Deluxe provides.

Though many may still recognize Deluxe as a check printer, McCarthy and crew are expanding beyond that notion. It retained the Deluxe name following the First American Payment acquisition because, over the 110-year-old company’s history, it had developed a trusted and respected reputation. “The brand actually means something to people,” McCarthy says. “We think the brand is elastic enough to stretch to digital payments.”

The bottom line, he notes, is that customers know what Deluxe is and it does not have to prove itself as it might under a new name.