Sixty-three percent of consumers in a survey of U.S., U.K., and German shoppers say they prefer to shop in person rather than online, with 70% of U.S. shoppers saying so. The results, released by payments platform Digital River, stemmed from a canvass of 3,000 consumers across the three countries. Garmin launched its …

Read More »To Grow Sales, Merchants Are Diversifying Into New Lines of Business, Square Finds

As consumers seek greater value from what they purchase, merchants are responding by diversifying their products and services to know their consumers better and grow sales, research from Square, Block Inc.’s merchant-processing unit, says. One way merchants are engaging consumers on a deeper level is through subscription services, which …

Read More »Grubhub Deploys Amazon’s Just Walk Out Tech on Campus

Students at Loyola University Maryland are the first to use Amazon.com Inc.’s Just Walk Out technology in a Grubhub partnership. The tech enables students, faculty, and staff to shop and walk out with their purchases billed within the app. Funding sources can be a meal plan, account balance, or credit …

Read More »Snack POS Adds PAX Devices And Other Digital Transactions News briefs from 8/29/23

Restaurant point-of-sale provider Snack POS has agreed to offer EMV terminals from Pax. Soundhound AI Inc., a specialist in artificial intelligence, said it will work with online-ordering platform ChowNow to help restaurants answer and respond to customer calls. Payments provider Nayax Ltd. is working with loyalty-technology platform Giift to enable consumers to convert loyalty …

Read More »Shift4 Grows Its Sports Portfolio By Signing the NHL’s St. Louis Blues

Shift4 Payments Inc. has expanded its stadium-pay domain by signing a deal with the National Hockey League’s St. Louis Blues to provide payment processing at the Enterprise Center, the team’s arena, and the adjacent Stifel Theater. Shift4 will also provide software for the Blues’ loyalty program, mobile wallet, and ordering …

Read More »Eye on Wallets: BMO’s Virtual Card Move; Startup Tezro Deploys a Wallet

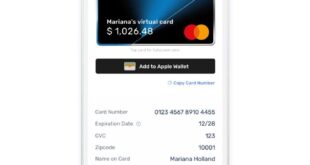

Digital wallets continue to find a foothold in payments. The latest entry is BMO Commercial Bank’s debut of Extend, a virtual card service for its app. And startup Tezro launched a digital wallet aimed at integrating banking, payments, and shopping through messaging apps consumers already use. BMO Commercial Bank, a …

Read More »VSoft’s Real-Time Pidgin Integration And Other Digital Transactions News briefs from 8/28/23

VSoft Corp., a specialist in financial-services technology, said its core-processing and digital-banking platforms are processing real-time transactions through an integration with instant-payments provider Pidgin. Payments providers ACI Payments and Link2Gov Corp. have been awarded Internal Revenue Service contracts worth $2.07 billion to support credit and debit card payments for taxes and user …

Read More »New SEC Rule Ups the Ante on Data Breach Disclosures

With the Securities and Exchange Commission mandating public companies victimized by a cyberbreach publicly disclose the breach, businesses need to be more diligent in keeping out cybercriminals, as disclosure of such information can subject them to greater scrutiny and potential liability. The rule, which the SEC passed in July, requires …

Read More »SoftPOS Offers Many Advantages, But a Few Drawbacks, Too

The recently developed ability to accept card payments on an ordinary smart phone, with no additional hardware, has electrified the payments industry. But the technology, known as SoftPOS, comes with complications that could slow progress, a panel of experts warned Thursday. SoftPOS, which as the name implies relies on specialized …

Read More »Affirm’s Revenue up, Though Loss Broadens And Other Digital Transactions News briefs from 8/25/23

Buy now, pay later provider Affirm Inc. posted fiscal fourth quarter revenue of $445.8 million, up 22.4% from $364.1 million in the quarter ended June 30, 2022. Its quarterly loss of $206 million broadened from $186.4 million a year ago. For the full year, Affirm had $1.588 billion in revenue, up 17.7% …

Read More »