Visa Inc. has spent more than $9 billion over the past five years to boost cybersecurity and reduce fraud, according to an announcement the network made in a blog post Tuesday. Of that amount, $500 million has been spent on artificial intelligence and data infrastructure. As a result of its …

Read More »There Are No Signs the Chip Shortage Is Easing, the U.S. Payments Forum Says

The microchip shortage that has plagued point-of-sale terminal makers since the onset of the Covid-19 pandemic shows no signs of abating. Despite forecasts that chip supply would not begin to start catching up to demand until mid-2022, terminal makers should continue to plan for shortages at least through 2023, according …

Read More »Block’s Square Unveils a Revamped Square Stand As Merchant Needs Evolve Fast

To help merchants manage their business through a single device in a rapidly changing payments landscape, Block Inc. on Monday introduced the next generation of Square Stand, the countertop device that converts an iPad into a point-of-sale system. It is the first redesign of Square Stand since its launch in …

Read More »Adyen Poised To Offer Tap to Pay on iPhone To U.S. Merchants

Processor Adyen NV is poised to be among the first to offer Apple Inc.’s Tap to Pay on iPhone service to U.S. merchants. Sometime later this year the service will launch, enabling compatible iPhones to accept contactless payments without the use of additional hardware or payment terminals. Announced in February …

Read More »Bolt To Acquire Wyre and other Digital Transactions News briefs from 4/7/22

The commerce platform Bolt has agreed to acquire the cryptocurrency provider Wyre to enable consumers to spend crypto at Bolt merchants, which will receive fiat currency. Terms of the deal, which is expected to close before year’s end, were not disclosed.In related news, payments platform Nium said it has partnered with cryptocurrency specialist BitPay to allow …

Read More »Eyeing the Contactless Market, MagTek Launches Its DynaFlex II And DynaProx Readers

Payments-technology provider MagTek Inc. on Tuesday launched the latest product on its DynaFlex platform, the DynaFlex II card reader, and also unveiled its DynaProx family of readers for transactions involving NFC mobile wallets as well as barcodes. The new technology follows a two-year span in which businesses have sought out …

Read More »The PCI Security Standards Council Launches the Latest Version of Its Security Standard

After years of soliciting input from more than 200 organizations in the payments industry, the PCI Security Standards Council Thursday published version 4.0 of the PCI Data Security Standard (PCI DSS). The new standard, which provides a baseline of technical and operational requirements designed to protect account data, replaces version …

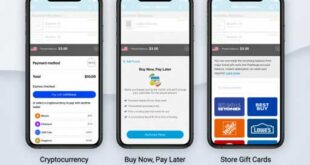

Read More »Crypto, Gift Cards, And Even BNPL Come to Unattended Payments Via PayRange

Transactions on gift cards and cryptocurrency—and even buy now, pay later capability—are coming to commercial washers, dryers, and vending machines with an announcement Monday by PayRange Inc. that it will support the new payment methods. The Portland, Ore.-based company, which says it processes for more than half a million commercial …

Read More »U.S. Merchant Acquiring Volume Surpasses $9 Trillion Even As E-Commerce Slows

The 25 biggest U.S. merchant acquirers control about 90% of payment dollar volume, even as e-commerce may be losing some of its recent momentum, according to the latest ranking of U.S. merchant acquirers by The Strawhecker Group, released this week. Overall, U.S. acquirers processed more than $9 trillion in payment …

Read More »With Its In-House Move, Apple Once Again Could Shake Up Payments

Almost eight years after it launched the Apple Pay mobile-payment service, Apple Inc.’s purported move to bring some of its payment-processing and financial-services operations in-house once again could shake up the payments industry. Just how, though, is a big unknown at the moment. Cupertino, Calif.-based Apple is not commenting on …

Read More »