Uber Technologies Inc. doesn’t say a lot about its payment strategy in the registration statement it issued Thursday ahead of its highly anticipated initial public offering of stock, but the filing does reveal the ride-share leader is an enormous generator of payment card volume and card-acceptance fees. The statement says …

Read More »Chase Racks up Double-Digit Volume Gains, While Wells Sees Digital-Banking Progress

Two the nation’s biggest banks on Friday reported gains in card volume, with JPMorgan Chase & Co. showing double-digit increases in merchant-processing volume as well as card spending. Chase’s first-quarter merchant volume totaled $356.5 billion, a 13% increase over the same period in 2018. The massive Chase Merchant Services unit …

Read More »Visa To Lower Its Chargeback and Fraud Ratios for Merchants in October

Visa Inc. will lower its merchant dispute and fraud ratios in October. Merchants that exceed the revised ratios could be placed in monitoring programs meant to control risk. Visa hasn’t announced the new standards publicly, but has informed the merchant-acquiring community. Digital Transactions News obtained some of the key new …

Read More »Most Full-Service Restaurants Are Frustrated With Their Payments Services, a Survey Finds

Frustration with payments runs high among full-service restaurant operators, so much so that only 20% expressed no frustrations in a new TouchBistro Inc. report released Monday. The other 80% had some issue with their payments services, with many of them, 21%, citing a lack of transparency on pricing. That was …

Read More »A New Refund Policy From PayPal Will Stop Returning Fees to Sellers on Canceled Sales

PayPal Holdings Inc. has posted some important policy changes set to take effect soon, including one that will stop refunding sellers for the commission part of the fee they pay on sales when buyers cancel. Sellers on forums like Reddit have been reacting for at least the last five days …

Read More »How Apple Card Heralds a Push for Greater Digital Authentication—And for Apple Pay

Apple Inc.’s forthcoming Apple Card is another push from the computing giant to move payments into a digital realm under Apple’s control, according to analysts. Apple last week announced the card, which bears a Mastercard Inc. brand and will be issued by Goldman Sachs Group Inc. The product, which eschews …

Read More »The Prepaid Business Adopts a Sanguine Approach As the CFPB’s Big Rule Finally Takes Effect

A day long dreaded by the U.S. payments industry came and went on Monday with little fanfare and not much more gnashing of teeth. The Consumer Financial Protection Bureau’s voluminous prepaid card rule finally took effect with sweeping provisions governing matters ranging from fee disclosures to error-resolution rights to consumers’ …

Read More »The Future of Tokens Will Extend Beyond Payments

As more and more companies adopt tokens as a proxy for the primary account number and other sensitive payment data, the day is fast approaching when the utility of the technology will move beyond the payments box. That’s the forecast from Nate Morgan, senior director for product management at CyberSource, …

Read More »In an Active Week for Worldpay, the Big Processor Says It Will Be Amazon Pay’s First Acquirer

As if the announcement of its pending merger with Fidelity National Information Services Inc. wasn’t enough news for one week, Worldpay Inc. on Wednesday said it will acquire Amazon Pay transactions for online merchants. The news means Cincinnati-based Worldpay has become the first merchant acquirer to work with the retailing …

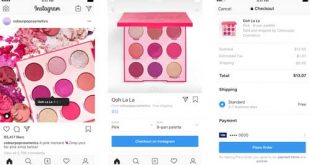

Read More »Instagram Testing Shoppable Ads With PayPal as Its Payments Partner

So-called shoppable ads could get a big boost if a tap-and-buy test announced Tuesday by Facebook Inc.’s Instagram social network succeeds, a test in which PayPal Holdings Inc. is the payment processor. Other social networks and Internet sites have rolled out or begun testing shoppable ads, including Pinterest, Snap Inc.’s …

Read More »