PayPal Holdings Inc. has posted some important policy changes set to take effect soon, including one that will stop refunding sellers for the commission part of the fee they pay on sales when buyers cancel.

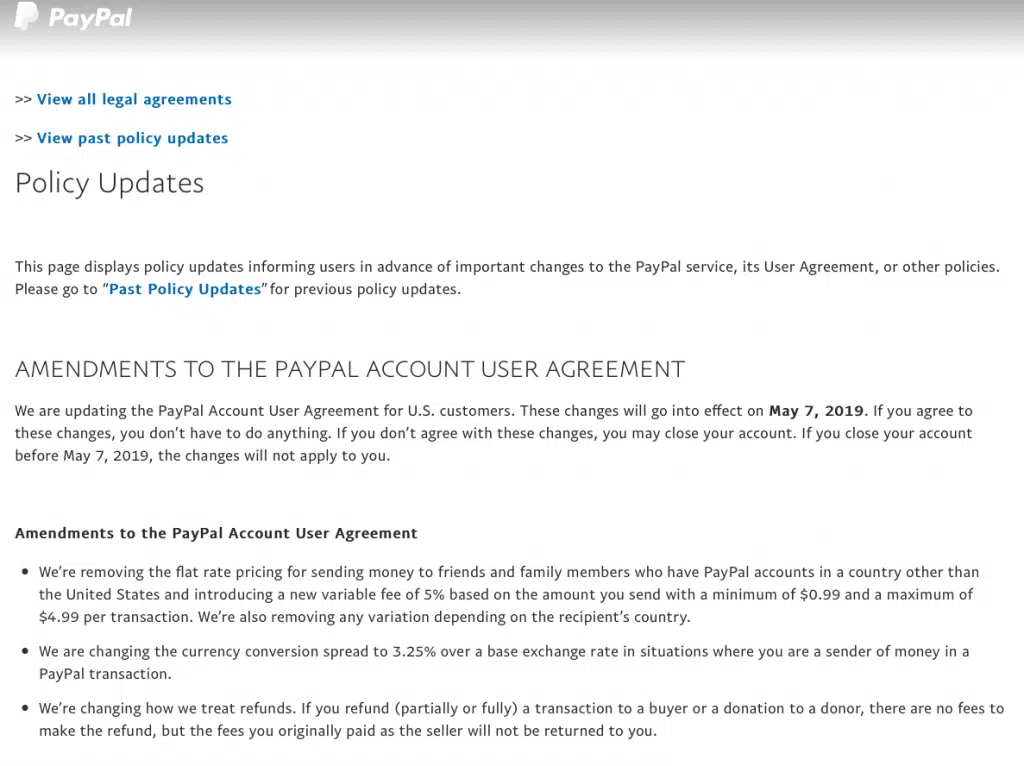

Sellers on forums like Reddit have been reacting for at least the last five days to the change, which will take effect May 7 and will rescind PayPal’s policy of refunding to sellers the percentage part of the fee it charges when sellers make a sale. Up to now, the company’s policy has been to refund that percentage, often 2.9% of the sale, when buyers ask for a refund. It does not refund the fixed fee, often 30 cents. With the new policy, PayPal will not refund the commission or the fixed fee on either full or partial refunds for either sales or donations.

The policy change appears on a PayPal “Policy Update” page. The page is undated, but the dates appearing on reactions posted by sellers indicate the seller community became aware of the change late last week. A PayPal representative tells Digital Transactions News the update was posted April 1. The change, he says, “brings us in line with return-fee policies across the industry.”

The new refund policy is drawing a mixed reaction, though most posts are negative. “Wow this has to be the worst change ever implemented,” laments one seller commenting on Reddit. Says another seller on the same forum: “Well, time to turn off PayPal for my Shopify store.” But another seller takes a more philosophical approach: “You could easily argue in a court of law that by PayPal making a reversal that in fact no service was provided and thus no fee can be charged.”

In other changes indicated in the same post, PayPal will start charging a 5% fee to users sending money to account holders outside the United States. The new fee, which replaces what PayPal calls its flat-rate pricing, won’t vary by country and will range from a minimum of 99 cents to a maximum of $4.99.

Also, in reaction to a sweeping new regulation taking effect for prepaid accounts, PayPal is requiring users who want to “hold and use a balance” to set up a new account linked to their existing PayPal account. The new account comes in two types, PayPal Cash or PayPal Cash Plus. The 1,600-page regulation, which took effect April 1, was drawn up by the Consumer Financial Protection Bureau.