The impending arrival of a commercial real-time payments service from no less an entity than the Federal Reserve will be a major event, but one Mastercard Inc.’s top brass says the card company will take in stride. “We’ll have to wait and see how it plays out, we’re well-positioned,” Michael …

Read More »Visa Credit Card Volume up 5.2% And Other Digital Transactions News briefs from 4/26/23

Visa Inc.’s U.S. debit card payments volume of $767 billion in its fiscal second quarter increased 9.6% from $699 billion in the quarter ending March 31 a year ago. Its U.S. credit card payments volume of $704 billion was a 10.5% increase from $638 billion a year ago. For all regions, Visa’s …

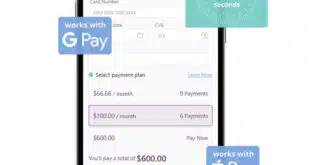

Read More »Eye on BNPL: Splitit Speeds Checkout; Klarna Introduces Personal Shopping Feed

White-label buy now, pay later provider Splitit Payments Ltd., introduced on Tuesday SplititExpress, a checkout experience that enables consumers to complete checkout in less than two seconds, compared to one-to-two minutes for other BNPL applications, Splitit says. The new feature also supports installment payments via Google Pay and Apple Pay. …

Read More »Fiserv’s Merchant Business Leads First Quarter Growth

Giant processor Fiserv Inc. said its revenue from its merchant business increased to $1.85 billion in the first quarter, a 12.1% increase from $1.65 billion a year ago. Brookfield, Wis.-based Fiserv said its two other segments—financial technology and payments and networks—also had revenue increases. Revenue for the financial technology business …

Read More »The ACH And Debit Top the Growth Charts, According to the Latest Fed Study

Payments analysts looking for where the growth is can find it in the automated clearing house network and in debit cards. With respect to transaction volume, no U.S. payment system grew faster over the three years from 2018 to 2021 than the ACH, which posted a compound annual growth rate …

Read More »Payroc Launches Tap to Phone And Strengthens Its Hand in Unattended Payments

Payroc LLC has partnered with wireless-network platform provider Bleu to launch tap-to-phone payments for Android and iOS devices in the United States. Merchants will be able to accept payments using a smart phone or tablet device. The rollout of tap-to-phone technology is expected to help merchants meet consumers’ evolving expectations …

Read More »Looking to North American Expansion, the U.K.’s Miura Launches an Android POS Device

The United Kingdom-based point-of-sale technology specialist Miura Systems has launched its latest payment device, an Android-based terminal called the Miura Android Smart POS, or MASP. It’s the latest payment-acceptance device aimed at independent sales organizations and other third-party resellers to take advantage of the open-source capabilities of the Android operating …

Read More »Cards in a Real-Time Payments World

As a new phase of real-time payments in the United States draws near, don’t expect payment cards to go away any time soon. That’s the consensus from several speakers at the Smarter Faster Payments 2023 conference sponsored by Nacha this week in Las Vegas. Each time a new payment rail …

Read More »Square Launches Tap to Pay for Android in the United States And Five Other Markets

Square, the point-of-sale and e-commerce unit of Block Inc., Wednesday announced the launch of Tap to Pay on Android for merchants in the United States, Australia, Ireland, France, Spain, and the United Kingdom. The technology will enable Square merchants to accept contactless payments with a compatible Android device, such as …

Read More »Darwinium Evolves to San Francisco And Other Digital Transactions News briefs from 4/19/23

Darwinium, a fraud-prevention platform serving payments providers and fintechs from global offices in London and Sydney, announced its expansion into the U.S. market, including relocation of its corporate headquarters to San Francisco. Some 65% of treasury officers reported their organizations were victimized by attempted or actual fraud last year, the …

Read More »