USAA, a pioneer in developing remote deposit capture, said it is “inviting” banks and credit unions to license the patent rights to its RDC technology, for which the financial-services giant holds approximately 50 patents. Launched in 2006 as a way to enable USAA’s customers, many of whom are in the …

Read More »Investors Pour More Funding Into Cybersecurity Startups As Cyberthieves Ramp up Attacks

As cyber attacks grow more vicious, investors are pouring more money into startups whose technology is aimed at thwarting online thieves. Funding deals for private cybersecurity firms reached 139 in the first quarter, the highest quarterly number recorded over the past five years by CBInsights, a New York City-based research …

Read More »Bitcoin at $2,000: The Digital Currency’s Heady Ascent Obscures Its Payment Function

Like it or not, Bitcoin has momentum behind it. On Saturday, the digital currency breached the $2,000 level for the first time ever, and by Monday morning it was trading just shy of $2,200, according to CoinDesk, an online service that tracks cryptocurrency. That represents a quintupling in value since …

Read More »Parking Kitty Debuts in Portland and other Digital Transactions News briefs

• Universal Secure Registry LLC, a developer of computer-security and mobile-payment services, alleges in a federal lawsuit that Apple Inc. and Visa Inc. infringed on its patents for electronic payments and identity authentication as they developed their mobile-payment services. Apple and Visa did not immediately respond to requests for comment. • The …

Read More »Visa Gets a Lot of Likes, But the Card Brands as a Group Don’t Get Much Love

Consumers may like the leading payment brands, especially Visa, but they don’t connect with them on an emotional level, according to new research findings from payments-industry consulting firm The Strawhecker Group. Asked if they “have any emotional connection” to any of the brands, some 77% of TSG’s respondents said no. …

Read More »Cayan’s New Card Reader Targets Software Developers And Vendors

Cayan’s new Genius Mini card reader may look like any number of headphone-jack or Bluetooth devices meant to connect to a smart phone or tablet to enable payment card acceptance. That’s because it’s the software the Genius Mini uses that distinguishes it from similar devices. The device is designed to …

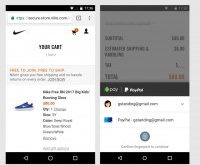

Read More »Android Pay Makes a Deal With First Data’s Clover And Extends One With PayPal

Recruiting massive processor First Data Corp. and existing partner PayPal Holdings Inc., the Google unit of Alphabet Inc. on Wednesday announced critical extensions of its Android Pay mobile-payment service into both physical and online commerce. In an arrangement that will become available to merchants and developers later in 2017, Atlanta-based …

Read More »North American Bancard Buys Total Merchant Services As Acquirer Consolidation Continues

Two powerhouse independent sales organizations are joining together. North American Bancard Holdings LLC is buying Total Merchant Services Inc. for an undisclosed amount. Woodland Hills, Calif.-based TMS processes more than $12 billion in annual transactions, which when added to NAB will result in more than $50 billion in annual processing …

Read More »Clearent Offering Quick Chip Technology and other Digital Transactions News briefs

• Processor First Data Corp. unveiled its First Data Global PFAC service for payment facilitators, which includes a single integration interface that enables merchants to authorize, settle, and fund transactions in more than 40 countries and 17 currencies. • Payment processor Clearent LLC is offering Visa Inc.’s Quick Chip technology to software vendors as …

Read More »Square Lays out Its Strategy for Growth at an Upbeat Investor Day Presentation

Square Inc. outlined its growth plans with an emphasis on selling new services and expanding internationally during its first investor day on Tuesday. In its presentation, Square said it wants to improve the efficiency of acquiring merchants, which it calls sellers; move its services up market to larger merchants; grow …

Read More »