Visa Inc.’s U.S. debit card payments volume of $767 billion in its fiscal second quarter increased 9.6% from $699 billion in the quarter ending March 31 a year ago. Its U.S. credit card payments volume of $704 billion was a 10.5% increase from $638 billion a year ago. For all regions, Visa’s …

Read More »Eye on BNPL: Splitit Speeds Checkout; Klarna Introduces Personal Shopping Feed

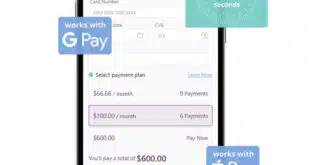

White-label buy now, pay later provider Splitit Payments Ltd., introduced on Tuesday SplititExpress, a checkout experience that enables consumers to complete checkout in less than two seconds, compared to one-to-two minutes for other BNPL applications, Splitit says. The new feature also supports installment payments via Google Pay and Apple Pay. …

Read More »Fiserv’s Merchant Business Leads First Quarter Growth

Giant processor Fiserv Inc. said its revenue from its merchant business increased to $1.85 billion in the first quarter, a 12.1% increase from $1.65 billion a year ago. Brookfield, Wis.-based Fiserv said its two other segments—financial technology and payments and networks—also had revenue increases. Revenue for the financial technology business …

Read More »Ingenico Releases App Tool And Other Digital Transactions News briefs from 4/25/23

Payments-technology provider Ingenico launched its AXIUM Payment Experience, dubbed APEX, an app intended to make it easier for businesses to craft payments apps. U.S. payments provider InComm Payments introduced a new unit, InComm Payments Brazil Technology Ltda., to expand the company’s operations in Brazil. Embedded-finance specialist Maast launched a set of new technologies aimed at making …

Read More »Eye on Tap to Pay: MagicCube Teams Up With ACI; Fiserv Offers Tap to Pay on Clover

The momentum behind tap to pay technology on smart phones shows no signs of slowing down. MagicCube Inc., which has traditionally focused on providing contactless payment technology to small merchants through off-the-shelf mobile devices, has expanded its reach to small and mid-sized merchants through a partnership with ACI Worldwide Inc. …

Read More »Priority’s New MX POS Platform And Other Digital Transactions News briefs from 4/24/23

Payments provider Priority Technology Holdings Inc. said it is launching MX POS, a point-of-sale platform offering cloud accessibility with analytics and data reporting. Chargebacks911, a platform for chargeback management, advised merchants to streamline subscription-cancellation processes in response to a proposal from the Federal Trade Commission to require merchants to make it as easy to …

Read More »Payroc Launches Tap to Phone And Strengthens Its Hand in Unattended Payments

Payroc LLC has partnered with wireless-network platform provider Bleu to launch tap-to-phone payments for Android and iOS devices in the United States. Merchants will be able to accept payments using a smart phone or tablet device. The rollout of tap-to-phone technology is expected to help merchants meet consumers’ evolving expectations …

Read More »Looking to North American Expansion, the U.K.’s Miura Launches an Android POS Device

The United Kingdom-based point-of-sale technology specialist Miura Systems has launched its latest payment device, an Android-based terminal called the Miura Android Smart POS, or MASP. It’s the latest payment-acceptance device aimed at independent sales organizations and other third-party resellers to take advantage of the open-source capabilities of the Android operating …

Read More »Cuban’s Drug Co. Taps RevSpring And Other Digital Transactions News briefs from 4/21/23

RevSpring Inc. said it is the payment partner to the Mark Cuban Cost Plus Drug Co., a new program for U.S. pharmacies. Cheq Inc., a mobile-payments provider serving the hospitality industry, said its technology will fulfill food orders at The Bite of Seattle, a festival set for July 21-23 and expected …

Read More »Cards in a Real-Time Payments World

As a new phase of real-time payments in the United States draws near, don’t expect payment cards to go away any time soon. That’s the consensus from several speakers at the Smarter Faster Payments 2023 conference sponsored by Nacha this week in Las Vegas. Each time a new payment rail …

Read More »