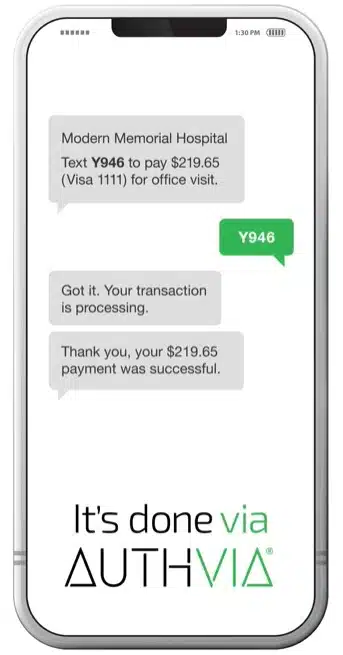

Authvia, a provider of text-to-pay and conversational-commerce technology for independent software vendors, independent sales organizations, banks, and merchants, has integrated Visa Direct into its TXT2PAY platform. The integration allows merchants and businesses to initiate outbound disbursements, as well as receive inbound payments, in real time.

As a result, merchants will be able to issue refunds, insurance settlements, payments, incentives, and reimbursements to a consumer’s eligible Visa card or bank account through Authvia’s platform, the Cambridge, Mass.-based company says. Doing so will streamline the payment process by removing the need to issue a check or require the downloading of a separate app or logging into a payment portal to initiate payment, Authvia adds.

Payment recipients can verify their identity, confirm payout details, and, for eligible Visa card transactions, receive funds in real time.

“This [integration] allows businesses to move beyond cash, checks, and delayed ACH transfers and deliver funds instantly and securely through a simple text message,” Authvia chief executive and founder Chris Brunner says by email. “ACH” is a reference to the automated clearing house network. “For businesses, this means faster settlement, improved cash flow, and a more streamlined process for issuing refunds, reimbursements, incentives, and payouts,” adds Brunner.

On the consumer side, the integration means consumers, contractors, and vendors can have disbursements deposited to their eligible Visa debit card accounts in near real time, without needing apps, portals, or extra steps, according to Authvia. “It is about creating the fastest, safest, and most convenient experience on both sides of the transaction,” says Brunner.

Text-to-pay is a fast-growing payment option driven by the “universal adoption of mobile messaging, combined with the demand for simple, app-free payments” according to Authvia, which has more than 250 gateway integrations, application programming interfaces, and merchant-facing applications

“With artificial intelligence, rich communication services, and secure tokenized links, text-to-pay is no longer just convenient, it is PCI-compliant, scalable, and future-proof,” Brunner says. “The result is faster payments, reduced administrative costs, and better customer satisfaction.”