Socure, an AI platform for digital identity verification and fraud prevention, announced early Wednesday the launch of Hosted Flows, fraud-detection technology that enables users to build, customize, and deploy branded identity verification and fraud prevention capability without the need for programming code. With Hosted Flows, product, risk, and compliance teams …

Read More »How PayPal’s Ads Manager Helps Cement Its Links to Merchants

PayPal Holdings Inc. has officially launched PayPal Ads Manager, a service that allows merchants to act as their own retail media network and generate new revenue streams, PayPal says. Retail media networks are advertising platforms that allow retailers to sell ad space across the media channels they own or control, …

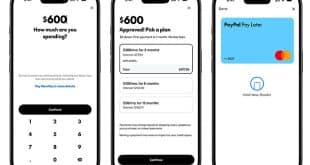

Read More »PayPal Adds Cash Back to BNPL for the Holidays And Expands BNPL to In-Store Purchases

PayPal Holdings Inc. announced it is offering 5% cash back to U.S. consumers using its buy now, pay later payment option for purchases through the end of the year. In addition, PayPal is rolling out its Pay Monthly BNPL option to in-store shoppers. The moves are expected to make PayPal’s …

Read More »Consumer Spending Rose Slightly in September as Consumers Turn Pragmatic in Purchasing, Fiserv Finds

Small businesses continued to see slow but steady month-over-month sales growth in September, according to the Fiserv Small Business Index. Month-over-month sales increased 0.1% in September from August, while transactions increased 0.3%. Average ticket sizes fell 0.2% from August. Overall, the metric for the index held steady at 148 for …

Read More »Merchants, Government, And Law Enforcement Look to Fight Gift Card Fraud

The Gift Card Fraud Prevention Alliance is launching a nationwide social-media campaign to combat gift card fraud this holiday shopping season. The campaign, which runs from Oct. 1 through Christmas Day, will deliver daily messages through the LinkedIn and Instagram platforms on the tactics criminals use to perpetrate gift card fraud …

Read More »Jack Henry Acquires Victor Technologies; Global Payments Sheds Its Payroll Business

Jack Henry & Associates Inc. has acquired Victor Technologies Inc., a provider of embedded-payment solutions, from MVB Financial Corp. for an undisclosed sum. While terms of the deal were not disclosed, MVB says it expects to see a pre-tax gain of $33 million from the sale. The acquisition widens an …

Read More »OpenAI And Stripe Are the Latest Fintechs to Enable Agentic Commerce

Agentic commerce got a huge boost late Monday as OpenAI, the provider of such artificial-intelligence applications as ChatGPT, launched Instant Checkout, an agentic-commerce protocol developed with Stripe Inc. The Agentic Commerce Protocol is an open standard for AI commerce that enables AI agents to complete purchases on behalf of individuals …

Read More »Corpay Teams With Mastercard on Cross-Border Payments, While PayOS Leverages Mastercard Agent Pay

Corpay Inc., a provider of corporate payment and expense-management technology, has extended its partnership with Mastercard Inc. to enable corporations, small businesses, and financial institutions to make near real-time payments to 22 new markets across Asia, Europe, the Middle East, Africa, and Latin America. The deal builds on the two …

Read More »Businesses Looking to Revamp Payment Strategies Will Embrace Digital Payments, an AFP Study Says

As the popularity of digital payments increases, more businesses and organizations are looking to revamp their strategies to keep up with the trend, according to the Association for Financial Professionals’ 2025 Digital Payments Survey. Among the businesses and organizations surveyed for the triennial study, 76% expect to update their payments …

Read More »Citi Teams With Dandelion to Enable Cross Border Payments to Digital Wallets

Citigroup Inc. is partnering with Dandelion Payments Inc., a real-time, cross-border payments network, to enable near-instant, full-value cross-border payments into digital wallets globally. Dandelion will integrate Citi’s WorldLink Payment Services into its digital-wallet network to facilitate the payments. The service will initially launch in the Philippines, Indonesia, Bangladesh, and Colombia. …

Read More »