The issue of consumer losses to fraud on peer-to-peer payment apps is about to get hotter as the Consumer Financial Protection Bureau is reportedly preparing a probe of the matter. The bureau’s action will likely include new requirements for banks to reimburse consumers victimized in cases where they sent cash …

Read More »MX Introduces Processor Tokens to Enhance Open Banking

In a move to streamline money movement and financial account openings for consumers, open-banking network MX Technologies Inc. on Tuesday unveiled what it calls MXapi Processor Tokens. MX enables fintechs to access consumer financial data, and helps its clients turn raw data into usable form. Token-based application programming interfaces (APIs) …

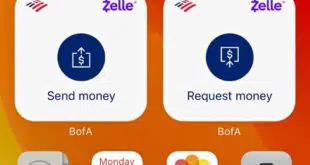

Read More »Zelle Volumes Climb Quickly for BofA, Surpassing Checks for the First Time

Five years after its launch, the Zelle person-to-person payments service continues to boost payment volumes for one of its founders, Bank of America Corp. BofA reported Monday that its second-quarter P2P Zelle transaction volume hit 239 million, up 26% from 189 million payments a year earlier. The value of the …

Read More »More Than Token Progress: Tokenized Payments Will Hit 1 Trillion by 2026, Juniper Predicts

The total volume of tokenized payment transactions worldwide will exceed 1 trillion by 2026, up from 680 billion this year, according to a report released Monday by Juniper Research. The growth will come mostly from click-to-pay options that allow buyers to pay with a single click, using tokenized credentials, the …

Read More »Synchrony Jumps Into The BNPL Game With an Assist From Fiserv’s Clover App Market

Synchrony Financial is the latest entrant in the highly popular, and increasingly crowded, buy now, pay later market. The Stamford, Conn.-based provider of consumer-financing products is partnering with Fiserv Inc. to allow merchants using Fiserv’s Clover platform to offer BNPL as a consumer-financing option. Called SetPay in 4, Synchrony’s BNPL …

Read More »COMMENTARY: How Can Neobanks Keep Up? The Answer Lies in Their Edge in Tech

In recent times, we have witnessed an explosion in the neobanking sector, with emerging digital-only providers benefiting from rapid digitization. Now, as this sector begins to mature, companies must find a way to retain customers that may want to transition back to traditional banking companies. To do so, businesses in …

Read More »Car IQ’s App Looks to Bring Fueling to Sunoco Fleet Customers at Nearly 5,000 Stations

Car IQ Inc. has inked a deal with petroleum company Sunoco LP to allow Sunoco’s fleet customers to purchase fuel without a credit card. Businesses, government agencies, and other organizations participating in Sunoco’s fleet program will be able to pay for gas at nearly 5,000 Sunoco stations by summer’s end …

Read More »Lit on Fire by Covid, E-Commerce Will Hit $20 Trillion Globally by 2026, RBR Says

It is generally accepted that the pandemic energized online commerce, but now research is starting to emerge showing just how extensive that effect has been. “Global Payment Cards Data and Forecasts to 2026,” a report released Wednesday by the London-based research firm RBR, indicates e-commerce card spending came to $7.7 …

Read More »Eye On BNPL: Blackhawk Network Teams With Klarna; Zip And Sezzle Pull Plug On Merger

Blackhawk Network Inc. is partnering with buy now, pay later provider Klarna AB to let consumers use Klarna’s interest-free payment solutions at physical retail locations. The deal, announced Wednesday, will enable consumers to make use of Klarna in-store for such items as groceries, electronics beauty, and more when shopping within …

Read More »Adyen Brings Tap-to-Pay on iPhone to U.S. Merchants

Apple Inc.’s long awaited tap-to-pay on iPhone technology is now live with Adyen NV merchants Vince, Burton, G-Star, and Scotch & Soda. The technology enables merchants to accept face-to-face payments using iPhones without special point-of-sale acceptance hardware. Consumers can use almost any near-field communication-enabled device, such as another iPhone, Apple …

Read More »