(Editor’s Note: This story follows up on news late Monday concerning a planned acquisition of Discover Financial Services by Capital One Financial Corp.) On the Tuesday morning after news broke that credit card giant Capital One Corp. intends to shell out $35.3 billion in an all-stock deal to acquire Discover …

Read More »The EU’s Fine Against Apple in Its Spotify Case Echoes a Familiar Story

The European Commission is planning to announce a fine of about 539 million euros ($500 million) on Apple Inc. next month after investigating a complaint from Sweden-based music app maker Spotify Technology SA regarding Apple’s policy of restricting apps from linking out to their own sites for services such as …

Read More »Toast Reports a Robust 2023 And Fourth Quarter As Dining Maintains Its Rebound

Shares in restaurant point-of-sale specialist Toast Inc. were trading modestly up early Friday following the company’s release late Thursday of December-quarter and full-year results indicating double-digit increases in client locations and payments volume and offering further evidence of the hospitality industry’s recovery from the 2020 pandemic. The results came as …

Read More »Global’s ‘Profac’ Model Starts Paying Dividends for Its Acquiring Business

A new tactic Global Payments Inc. began pursuing last year is delivering continuing benefits for the company as its merchant-solutions unit saw year-over-year point-of-sale volume growth of around 20% in the fourth quarter, top management at the big Atlanta-based processor said early Wednesday. Much of the credit for the growth …

Read More »At a Double-Digit Growth Rate, BNPL Isn’t Cooling off

The buy now, pay later trend emerged in the U.S. market in a big way in 2020 in the wake of the pandemic as a means to let strapped consumers make point-of-sale and online transactions with partial payments, while financing the balance over a short term. Since then, the U.S. …

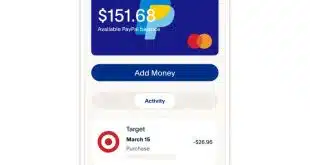

Read More »PayPal’s New CEO Begins Acting on His Promise to Shake up the Payments Giant

When Alex Chriss came from Intuit last fall to take over as chief executive of PayPal Holdings Inc., he made it plain there would be big changes in strategy coming soon. On Wednesday, he began delivering on that promise, asserting the payments company is going to promote so-called branded checkout …

Read More »Fiserv Logs Robust Results in Its Merchant Unit As Its Clover Tech Surges Ahead

Fiserv Inc., already a behemoth in merchant processing, is preparing to straddle its twin pillars of acquiring-bank relationships, on the one hand, and its own acquiring operations through a Georgia bank charter, on the other. The charter, which the big processor applied for last month, has “a very specific purpose,” …

Read More »As Its U.S. Business Slows, Mastercard Looks to Emerging Markets Like Real Time Payments

Mastercard Inc. is confronting a slowdown in dollar volume in its home market while it pushes into vital new markets like real-time payments and open banking, its presentation of fourth-quarter 2023 financial results indicated early Wednesday. Gross dollar volume of $727 billion in the December quarter represented a 4% rise …

Read More »AmEx Posts Strong Numbers As It Looks to Add Card Features And Cardholders

American Express Co. reported record revenue and record earnings early Friday as it posted a fourth-quarter 2023 performance that the company says proves it has put the languor of the pandemic behind it. “Looking back over two years, we have achieved what we set out to do. We are a …

Read More »How an Ingenico Integration With Cybersource Promises a Global Point of Sale

Ingenico, one of the world’s largest makers of point-of-sale transaction devices, said early Tuesday it has worked with Visa Inc. to integrate its Axium terminal software with a payment platform operated by Cybersource, Visa’s commerce and fraud-management unit. The move promises to offer, from a single platform, a service that …

Read More »