It’s a busy day for PayPal Holdings Inc. and its payments services. Five years after launching PayPal Pay in 4 in the United States, PayPal now offers the buy now, pay later product in Canada. PayPal also said Venmo, its social-based money movement service, launched Stash, a rewards program for users of the Venmo debit card and non-debit activity.

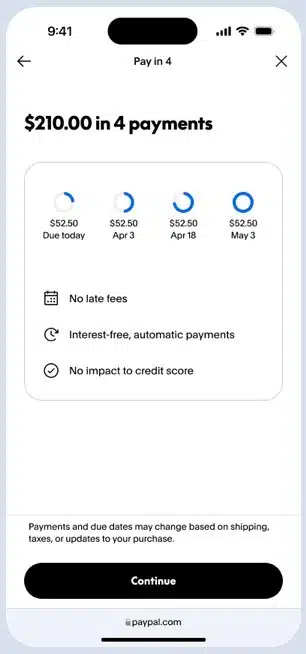

Pay in 4 offers four interest-free, bi-weekly payments for purchases ranging from $30 to $1,500, according to PayPal. As in the United States, Pay in 4 has no late fees or sign-up costs. Repayment is made via credit or debit or a bank account.

PayPal, in a statement to Digital Transactions News, says it is expanding Pay in 4 to Canada to “meet consumer demand this holiday shopping season as they look for more choice and flexibility at the checkout. Consumers are looking to manage their cash flow, and PayPal Pay in 4 gives shoppers the ability to split their payments into four interest-free installments.” PayPal is promoting Pay in 4 in Cadillac Fairview malls in Toronto, Montreal, Calgary, and Vancouver with in-person pop-up and online games offering prizes up to $1,000.

PayPal says its BNPL service has a 90% global approval rate, adding that sales with it have an 80% higher average order value than without it.

In related news, Venmo, which debuted in 2012 as a peer-to-peer mobile payment app, announced a rewards program for its users. PayPal, when it was owned by eBay Inc., acquired Venmo in 2013.

Dubbed Stash, the rewards program offers users 1% cash back when they spend their balance at 12 participating merchants. PayPal says Stash users can select merchant bundles that best suit them, choosing one bundle at a time and they can switch to another monthly. One bundle includes McDonald’s TikTok Shop, Uber, and Uber Eats. Another is Amazon, DoorDash, Domino’s, and Walgreens. The third is Walmart, Lyft, Taco Bell, ESPN, and GameStop.

They can get 2% when they turn on auto reloads and 5% cash back when they have direct deposits sent to their Venmo account each month. Venmo says additional ways to earn rewards are coming in 2026.

What makes this different from other rewards programs is that consumers earn rewards from spending and money management habits they already use with Venmo, says Diego Scotti, PayPal’s general manager of consumer. “Our cash back multiplier allows us to grow adoption and usage of our different products and recognize our customers for doing more with more value back to them,” Scotti says in a statement.

Adding rewards is another step in Venmo’s evolution from a P2P payment app to a full-featured commerce platform, PayPal says. “It incentivizes users to do more with Venmo, bringing more funds into the ecosystem, spending in-store and online, and earning meaningful rewards on their purchases,” PayPal says.