PayPal Holdings Inc. on Tuesday launched a new version of its mobile app with a panoply of new shopping and financial features aimed at broadening the product’s appeal with consumers who are increasingly turning to online commerce.

The big refresh, the first PayPal has executed on its digital wallet for at least seven years, includes features such as a high-yield savings account via long-time PayPal partner Synchrony Bank, cash back or PayPal shopping credit on spending, consolidated bill payment, direct deposit for early access to wages, and a utility to buy, hold, and sell cryptocurrency.

“It’s a shot across the bow for wallet and payment players like Apple Pay and Google Pay, [and] also traditional financial institutions and neo-banks,” says Thad Peterson, a senior analyst who follows mobile wallets for Boston-based AiteNovarica Group.

PayPal chief executive Dan Schulman promoted the app Thursday by billing it as a way for consumers to simplify their lives by consolidating a range of key functions behind one access point. “Our new app offers customers a simplified, secure, and personalized experience that builds on our platform of trust and security and removes the complexity of having to manage multiple financial or shopping apps, remember different passwords, and track loyalty rewards,” Schulman said in a statement.

The new app comes as consumers, who have been increasingly turning to digital wallets, demand apps that are streamlined and easy to use, PayPal says. The company cites statistics from Juniper Research showing that some 4.4 billion consumers will be using digital wallets by 2025, twice the number using them now. Of current users, almost half say simplicity is their number-one reason for using the app.

The new app also arrives as other payments-technology firms are launching new wallets or upgrading existing ones. Square Inc., for example, last week introduced a payments feature called Cash App Pay for its highly popular Cash App wallet. The app lets users pay merchants by scanning a QR code or by swiping a button their screens. Square says 70 million active users have adopted Cash App.

PayPal will add over the coming months investment features and yet more payment options for in-store and online shopping, the company said. The latter will include a capability for QR codes, a technology PayPal began deploying last year with chains such as CVS Pharmacy to ease contactless payments.

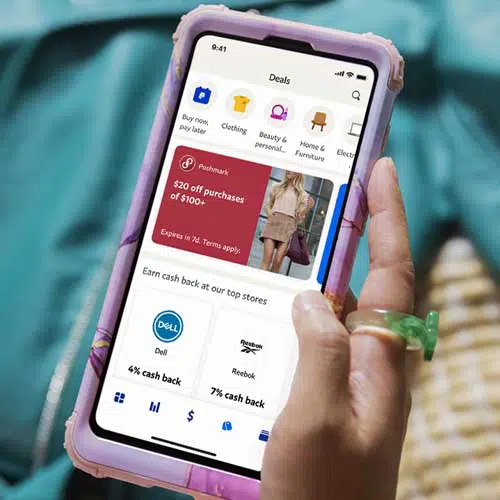

Thursday’s unveiling follows months of speculation about the product, which Schulman advertised in the July earnings call as a new “super app” for the payments company. PayPal is particularly high on shopping features such as the ability to locate deals, trigger a purchase, and earn rewards “seamlessly within the app,” according to the Thursday news release.

Another key feature is the app’s savings account, which offers a 0.40% rate, well above the national rate, which PayPal pegs at 0.06%. The shopping and rewards tools, meanwhile, will start rolling out to U.S. users “in the coming months,” the company said.

PayPal’s big and fast-growing account base is an advantage for the company’s new push into digital wallets, experts say. The active account base grew to 403 million by the end of June, a 16% jump compared to the end of the second quarter in 2020. That number includes some 32 million merchants.

But the adoption rate will be key, Peterson cautions. “PayPal has a massive user base and an equally huge merchant base. This could be a game-changer in commerce, payments, and banking, but only if their users adopt it,” he says. “That’s the test and we’ll find out in the next year or so if they passed.”