The buy now, pay later trend has eased online purchases for consumers over the past year, but at the other end of those transactions is the flow of returns after buyers get their merchandise. Now Affirm Holdings Inc., a leading player in the fast-growing BNPL arena has attacked the issue with a $300-million deal for Returnly Technologies Inc., a 7-year-old, San Francisco-based startup.

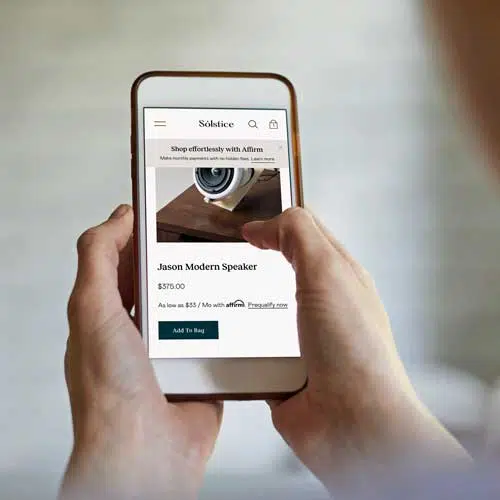

Unlike traditional layaway plans, BNPL options allow consumers to receive merchandise and then pay for it over three or four installments, though Affirm’s terms usually are three, six, or 12 months. With Returnly, Affirm will be able to offer users who are unhappy with the product when it arrives to get a replacement before returning the original item. Returnly, whose technology includes package tracking and other return-management services, says it serves 1,800 merchants and some 8 million consumers.

Installment purchases on BNPL plans have grown fast over the past year as e-commerce volume has swelled in response to pandemic-induced shopping restrictions at physical stores. While consumers returned $428 billion worth of merchandise in 2020, according to the National Retail Federation, returns on online sales occur at a rate roughly three times the pace seen for returns on in-store sales, according to data from Affirm, a 9-year-old company also based in San Francisco. Affirm had 4.5 million active users at the end of 2020, up 52% in one year.

“Over the last few years, alongside the rapid growth of online shopping, consumers’ expectations of accommodations for returns and exchanges have increased significantly,” Max Levchin, Affirm’s chief executive and founder, said in a statement.

Affirm first invested in Returnly in 2019, he added, because it saw a growing need for its technology. “Store credit, issued before the item is actually returned, is now a practical requirement in highly competitive segments like fashion and lifestyle,” said Levchin, who in the late 1990s was among the founders of PayPal.

Investors were responding well to the news. Affirm’s shares on the Nasdaq were trading at more than $66 at mid-morning Wednesday, up better than 2.5%. The company went public Jan. 13 at $49 per share.

The deal for Returnly is expected to close by June 30.