Buy now, pay later provider Afterpay Ltd. reported its bi-annual Afterpay Day sale, the first to include brick-and-mortar merchants, generated a 35% increase in new active users and sent 6 million referrals to merchants around the world from the company’s Shop Directory.

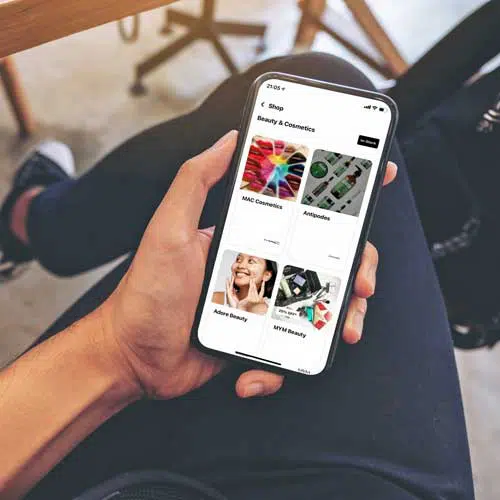

Eighty-six percent of the transactions made that day, March 25, were done on a mobile phone, Australia-based Afterpay says. A vast majority—91%—used a debit card for their purchases. In December, Afterpay said 90% of its transactions were made with debit cards. More than 3,000 retailers participated with deals and promotion.

Afterpay says more than 16 million U.S. consumers have signed up to use Afterpay and it counts more than 75,000 global retail participants.

In related news, Japan-based buy now, pay later provider Paidy Inc. closed on a Series D funding round totaling $120 million and backed by JS Capital Management LLC, Soros Capital Management LLC, Tybourne Capital Management Ltd., and Wellington Management.

Launched in 2014, Paidy now counts more than 5 million consumer accounts. It recently made its 3-Pay service available, enabling three equal installment payments for purchases.