The Calgary, Alberta-based processor Helcim Inc. has grown increasingly active in launching new services in recent years as more intense competition wears on midsize payments players. The company’s latest gambit: an extension that lets merchants access Helcim’s processing platform within the business software they already use, bypassing alternatives integrated within the software that may be more expensive.

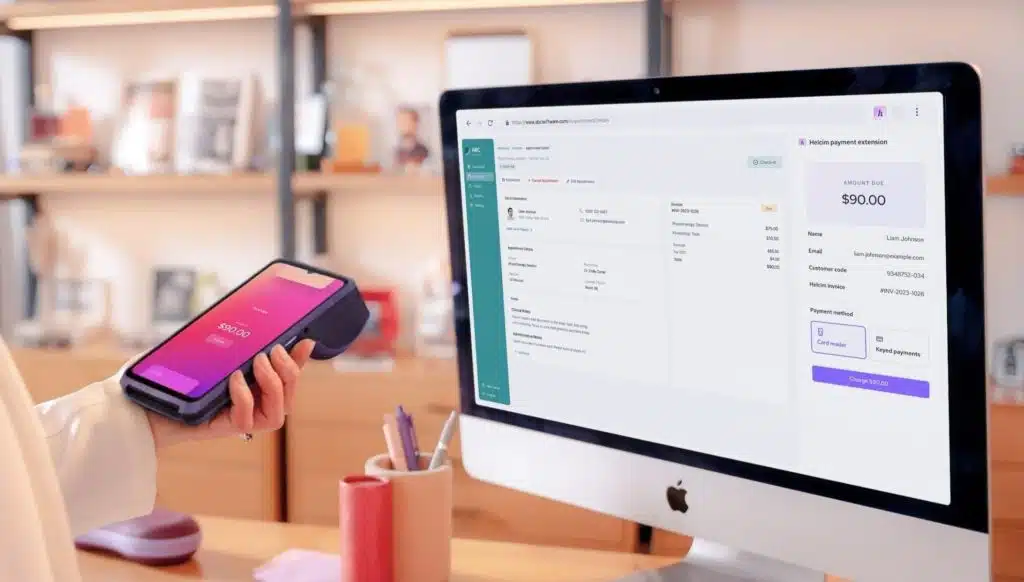

The extension, which Helcim says businesses can download now, works with more than 20 business-software programs, the company says, though plans are that by year’s end it will feature more than 100 such integrations.

Helcim’s position is that existing programs that automate functions such as inventory control or accounting may also offer payments but at higher rates than those available from payments specialists. The company’s move comes as sellers have grown increasingly restive over card-acceptance costs and as the payments industry and governments have acted to address the matter.

In the latest example of this trend, U.S. legislation re-emerged this week that proposes to control acceptance costs by encouraging more competition through a requirement that merchants have a choice of networks for transaction processing. The Credit Card Competition Act, first introduced in 2022, was reintroduced in the Senate Tuesday following an endorsement by President Trump.

Helcim’s extension will address rates from specialized software providers that are “often” pegged at 2.9% of the transaction value or higher, the company says. Helcim is not levying monthly fees or charges for setup, it says, while its pricing model is interchange-plus, based on volume. The extension, the company says, enables businesses to link their workflow to the company’s platform, enabling automated data entry.

“Business owners shouldn’t be forced to overpay for payments just to use the operational software they love,” Nick Beique, Helcim’s chief executive, says in a statement. “This extension restores the power of choice, allowing merchants to pair the best tools for their business with … transparent, affordable payments.”