Intuit Inc. recently announced that it will end support for its QuickBooks Desktop Point of Sale 19.0, one of the oldest payment-accepting POS systems in the market, as of Oct. 3. Intuit is referring users to Shopify Inc., but other payments companies are scrambling for the business. The date of …

Read More »Euronet’s epay Unit Unveils ‘No-Code’ Service for Flagging Fraudulent Transactions

Payment processor Euronet Worldwide Inc. on Wednesday announced a new fraud-monitoring service called Skylight the company says will enable analysts to write rules for monitoring suspicious transactions without needing to change software coding. The cloud-based service comes from Euronet’s epay division and runs on Microsoft Corp.’s Azure and Amazon.com Inc.’s …

Read More »CardX Expands Online Payment Capabilities with Mastercard Click to Pay

Payment processing platform CardX is making Mastercard Click to Pay available on Lightbox, its online payment form, to all existing and new card-not-present merchants on its platform. Mastercard Click to Pay stores a consumer’s payment information using an encrypted, virtual card number to enable secure online shopping. Lightbox enables consumers …

Read More »EV Charging Cash Back to PayPal Wallet And Other Digital Transactions News briefs from 4/5/23

Participants in the new SmartCharge New York electric-vehicle charging program in the New York City area can receive cash back to their PayPal or Venmo accounts if they charge their vehicles during low-demand hours. The program is overseen by electric utilities Con Edison and Orange & Rockland, which are working with ev.energy, …

Read More »Paper Checks the Preferred Method in B2B Payment Fraud, Survey Finds

More than half the U.S. companies polled in a recent survey—56%—said they were the target of at least one business-to-business payment-fraud attempt in 2022, with paper checks the leading fraud type. Furthermore, 43% of companies said they had been targeted more than once, and 12% said they had been targeted …

Read More »Eye On Small Businesses: PayPal Adds Apple Pay Checkout; NAB Picks Virtualitics for Data Insight

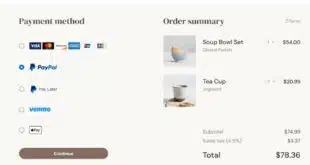

PayPal Holdings Inc. has added four new features to its payment service for small online businesses that are expected to increase conversion, reduce declines and the risk of fraud, and provide greater transparency into processing costs. PayPal’s small business customers will now be able to offer Apple Pay at checkout, …

Read More »Finix Tags New Merchant Market And Other Digital Transactions News briefs from 4/4/23

Finix Payments Inc. released its payments service for merchants that want to use embedded payments. Its first product was geared to software platforms. The new segment provides payments processing while enabling the merchant to control their customers’ online and in-person shopping experiences. Aeropay, a cannabis industry payments provider, said it and Onfleet, …

Read More »PayPal Becomes Ticketmaster’s Preferred Payment Partner, a Boon for Braintree

PayPal Holdings Inc. says it is now the preferred payments partner of Ticketmaster, the big and often controversial multi-national ticketing business owned by Live Nation Entertainment Inc. The deal announced Monday is a boon for PayPal’s Braintree merchant-processing unit, which will become Ticketmaster’s main processor. Monday’s announcement essentially is an …

Read More »POSaBIT Expands Its Footprint In Cannabis Payment Processing With Hypur Acquisition

POSaBIT Systems Corp. strengthened its position in the cannabis-payments processing market with the $7.5 million acquisition of Scottsdale, Ariz.-based Hypur Inc., a provider of payment and compliance solutions to high-risk merchants, including cannabis dispensaries, CBD retailers, and merchants that accept cryptocurrency. POSaBIT says the acquisition will provide it with a …

Read More »Coinhub Places More Bitcoin ATMs And Other Digital Transactions News briefs from 4/3/23

Coinhub said it recently secured placement of its Bitcoin ATMs at more than 1,000 gas stations and stores. Parthenon Capital announced it has closed on its $415 million acquisition of Pavilion Payments, previously known as Global Payments Gaming Solutions. The deal was announced in February. Global Payments will continue to process for Pavilion. …

Read More »