Companies offering payment solutions generally face an important decision in their early days: settling on the right operating model. Should we function as a payment facilitator (payfac) and do everything ourselves? Should we register as an acquirer, ISO, or third-party processor? Should we handle risk and underwriting? How should we …

October, 2021

-

29 October

Amazon One Expands and other Digital Transactions News briefs from 10/29/21

Amazon.com Inc. said its Amazon One technology, which scans customers’ palms to process payments, is now available at more than 70 Amazon physical stores, Whole Foods stores, and third-party locations.Merchant acquirer Shift4 Payments Inc. released a business update indicating its volume for October was 80% higher than the same month in 2020, with the number …

-

27 October

[UPDATE] POS Device Maker Pax Draws Scrutiny Following Allegations of ‘Strange Network Activity’

[UPDATED TO REFLECT A STATEMENT FROM PAX] A report released on Tuesday detailing a raid by federal investigators at a Florida warehouse linked to Pax Technology Inc. has stunned the payments industry and left some observers concerned about the big point-of-sale device maker’s reported reaction to allegations its technology was …

-

27 October

Fiserv’s Merchant Volume Jumps 20% and other Digital Transactions News briefs from 10/27/21

Global merchant dollar volume grew 20% in the third quarter year-over-year for processor Fiserv Inc., while global e-commerce volume increased 21%, the company reported. Overall global transactions expanded 16%. The company did not report actual figures. Revenue for the quarter was $3.96 billion, up 10%. Year-to-date revenue was $11.37 billion, an …

-

26 October

BNPL Offers Big Potential for Market Share But Also Flashes Caution Signs for the Unwary, a Panel Says

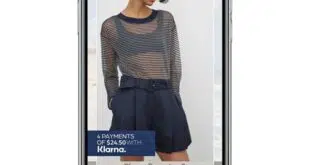

The rapidly unfolding buy now, pay later business holds huge potential for point-of-sale lenders but flashes caution signs for players that jump in without doing their homework, a panel of experts said Tuesday at the Money 20/20 exposition in Las Vegas. The BNPL product, which generally allows shoppers to pay …

-

25 October

A Bread Partnership Adds More Long-Term Financing Power to Sezzle’s BNPL Arsenal

As part of its strategy to become a full-service payments provider and serve a wider consumer base, buy now, pay later provider Sezzle Inc. on Monday announced a partnership with Alliance Data Systems Corp. to offer Alliance Data’s Bread installment-loan service to Sezzle merchants. The partnership builds on a deal …

-

20 October

Stripe Strikes Again In Executing Its Strategy to Expand Beyond Online Payments Acceptance

Building on its strategy of expanding beyond payments acceptance, Stripe Inc. on Wednesday announced the acquisition of Recko Inc., a provider of payments-reconciliation software for Internet businesses. Terms were not disclosed. The deal follows the debut of new applications this year intended to carry out this strategy, such as Stripe …

-

20 October

How Consumers’ Growing Adoption of BNPL Is Getting the Ad Dollars Flowing

The heady times for buy now, pay later just keep on rolling. Now, with 44% of consumers saying they have used BNPL options to make a purchase, according to personal-finance company Credit Karma LLC, providers of the point-of-sale financing have opened the ad-spending spigot. A new report from MediaRadar, a …

-

19 October

Intuit Expands Its Payments Reach to Small Businesses And Takes Aim At Square

Sensing an opportunity to expand the reach of its financial services to more small businesses, Intuit Inc. on Tuesday introduced Money by QuickBooks, a mobile app intended to make it easier for small sellers to accept payment, manage their cash flow, and pay bills. Intuit launched the app in response …

-

19 October

B2B and Health-Care Payments Help Drive a Robust Quarter for the ACH

Driven by a surge in business-to-business and health-care claims payments, transactions on the nation’s automated clearing house network swelled 7.7% year-over-year in the third quarter, according to Nacha, the organization that governs the network. Transactions totaled 7.3 billion, up by 520 million, while dollar volume totaled $18.1 trillion, a 13/8% …