Galileo Financial Technologies LLC has expanded its buy now, pay later offering to small businesses for business-to-business purchases. The offering is available to lenders and fintechs using Galileo’s technology. They will have the option to customize the total number of installment payments for BNPL loans, according to Galileo. Galileo, which …

October, 2023

-

5 October

Small-Screen Shopping Set To Dominate 2023 Holiday Spending

One of the first forecasts for the upcoming 2023 holiday shopping period predicts that mobile devices will overtake desktop ones for e-commerce for the first time. Adobe Inc., in its Nov. 1-to-Dec. 31 holiday-shopping forecast, released Thursday, forecasts that U.S. online holiday sales will reach $221.8 billion, a 4.8% increase …

-

5 October

Mapbox’s In-Car Payments And Other Digital Transactions News briefs from 10/5/23

Location-technology vendor Mapbox launched MapGPT, an automobile-based voice assistant incorporating generative artificial intelligence. Among its features is an ability to process payments, starting in Japan with that country’s PayPay app. Stop & Shop and Food Lion have adopted a mobile shopping app from Peapod Digital Labs, an e-commerce technology developer for Ahold Delhaize …

-

4 October

PayPal Makes Good on Its Apple Pay Card Vow

Almost a year after vowing to make its PayPal- and Venmo-branded credit and debit cards available in Apple Wallet, PayPal Holdings Inc. has come through on that promise. With the move, announced Wednesday, eligible PayPal and Venmo cards can be added to Apple Wallet by tapping the “Add Debit or …

-

4 October

Eye on AmEx: PayNearMe Adds Accertify’s Anti-Fraud Tech for iGaming; A New Gold Business Card

PayNearMe Inc. is beefing up the fraud-fighting capabilities of its MoneyLine iGaming and sports-betting platform via an integration with Accertify Inc., a subsidiary of American Express Co. The integration will enable iGaming and sports-betting operators to reduce fraudulent withdrawals from iGaming accounts by confirming an accountholder’s identity prior to a …

-

4 October

Ripple Gets Singapore OK And Other Digital Transactions News briefs from 10/4/23

U.S.-based blockchain platform Ripple Labs Inc. said its unit in Singapore, Ripple Markets APAC Ltd, has received a Major Payments Institution license from Singapore’s Monetary Authority, enabling Ripple to go on providing regulated digital-payment token services in that country. Online grocery-delivery service Instacart said it will now accept payments from users through Medicare Advantage …

-

3 October

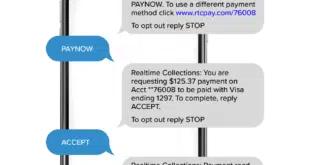

Nuvei Works With Solutions By Text for Embedded Bill Pay And Gains a Footprint in China

Solutions by Text is adding embedded bill-payment capabilities to its FinText messaging and payments platform. Consumers will now be able to pay bills through the FinText platform without leaving the platform’s Web site or mobile app, which creates a more convenient payment experience, the company says. Transactions will be processed …

-

3 October

SpotOn Retreats From Stadiums to Focus on the Restaurant POS Market

Count one less competitor in the market for advanced point-of-sale technology at stadiums. Shift4 Payments Inc. has agreed to buy SpotOn Transact Inc.’s sports and entertainment business for $100 million in a move that beefs up Shift4’s position in the burgeoning stadium market and marks a retreat by SpotOn from …

-

3 October

FedNow Tally at 108, up from 35 And Other Digital Transactions News briefs from 10/3/23

The Federal Reserve said FedNow, its real-time payments service that launched in July with 35 banks and credit unions, now counts 108 participating institutions with 21 others providing liquidity and settlement services and 20 service providers. Kenneth C. Montgomery, the Federal Reserve Bank of Boston first vice president and chief operating officer who spearheaded …

-

2 October

Experian Launches a Checking Account With a Debit Card in a Move to Boost Credit Scores Faster

Experian PLC on Monday launched its Smart Money digital checking account and debit card. The product is part of the credit bureau’s strategy to offer consumers with no or minimal credit histories an opportunity to quickly build a credit score. To that end, Experian has embedded in the new product …