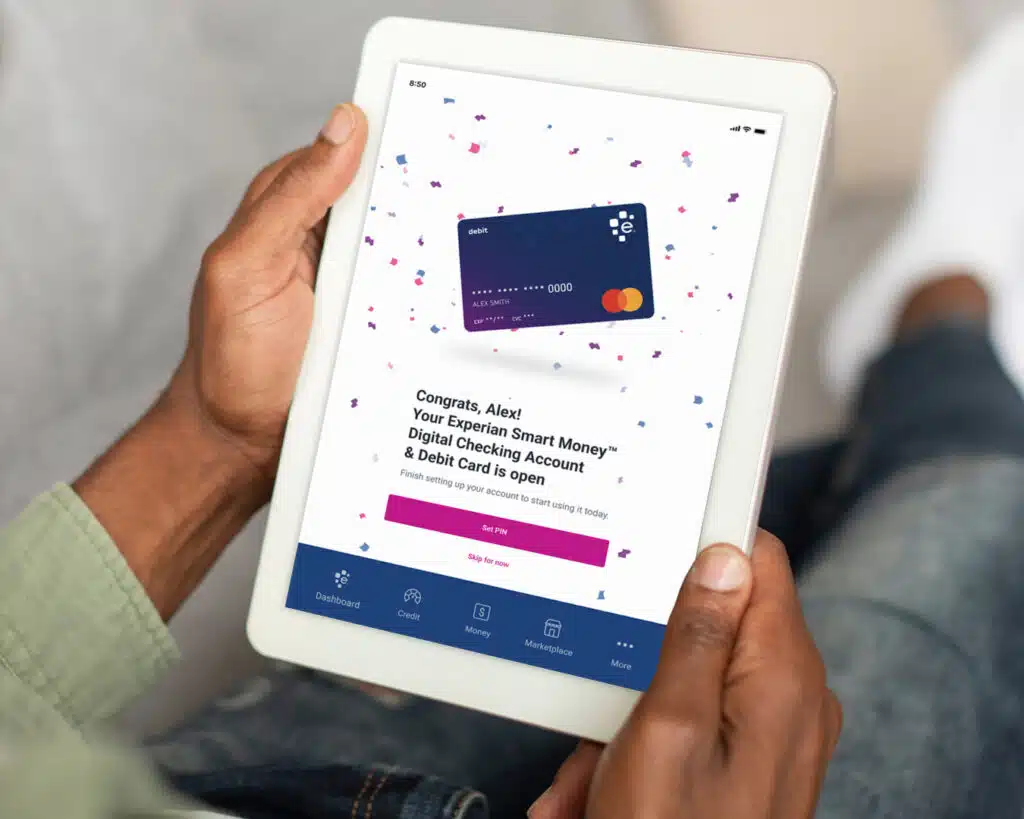

Experian PLC on Monday launched its Smart Money digital checking account and debit card. The product is part of the credit bureau’s strategy to offer consumers with no or minimal credit histories an opportunity to quickly build a credit score.

To that end, Experian has embedded in the new product Experian Boost, an app that counts on-time bill payments, such as rent or utility payments, towards a consumer’s credit score. Typically, such payments are not factored into the reckoning of credit scores.

Providing young adults the tools to start building a credit score is important, Experian says, as 58% of Gen Zers do not know how to do it. More than 14 million consumers have connected to Experian Boost, which launched in 2019, via a checking account or credit card. On average, consumers connected to Experian Boost have raised their Experian credit score by 13 points, the credit bureau says.

In addition to the integration with Experian Boost, consumers can use their Smart Money debit card to access more than 55,000 surcharge-free ATMs within the Allpoint network, Experian says. Community Federal Savings Bank will issue the card on Experian’s behalf. Smart Money account holders enrolled in direct deposit will also be able to have a paycheck deposited in their account up to two days early.

The launch of the Smart Money digital checking account follows the introduction last year of Experian Go, which allows consumers to create their own Experian credit report, even if they don’t have any credit accounts, such as a loan or credit card.

“With Experian Boost and Experian Go, we enabled millions of people who pay bills regularly to leverage their positive payment history to build their credit profiles. Now, we’ve made it more seamless to have those positive payments reflected with the Experian Smart Money Digital Checking Account so more consumers can reach their fullest financial potential,” Jeff Softley, group president of Experian Consumer Services, says in a statement. “This offering is a natural next step in how we are using our technology to provide consumers greater credit-building power and financial control.”