A large portion of Apple Inc.’s customers spurn facial biometrics, a key security element in Apple’s new iPhone X, according to new research. Survey results from United Kingdom-based Juniper Research say that more than 40% of users of Apple’s mobile devices in the U.S. consider themselves unlikely to use facial …

Read More »With its New iPhone X, Apple Brings Facial Biometric Authentication to Apple Pay

The Apple Pay mobile-payments service got only a few brief mentions in a nearly two-hour presentation Tuesday afternoon in which Apple Inc. executives introduced the latest versions of their 10-year-old iPhone and other new products. But what they did say could change payment security because the new iPhone X will …

Read More »What Growing Pains? In-Store Mobile-Payment Volume Is Rising Fast, Researcher Says

Enthusiasts may lament the slow rate of adoption for mobile payments generally in the United States, but some researchers are forecasting robust growth for contactless payments via mobile wallets at the point of sale. In a recent report, New York City-based research firm eMarketer said so-called proximity mobile payments will exceed $1,000 …

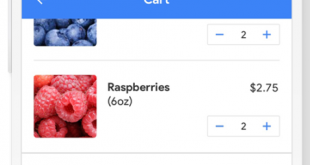

Read More »Google Aims To Leverage Its Millions of Credit Card Credentials for Mobile Commerce

Google plans soon to give merchants access to the vast trove of credit card credentials it has in its databases to speed customer checkout for mobile and online payments. The search-engine giant, however, is not putting itself in competition with payment card networks, a Google executive said this week. The …

Read More »PCI Compliance Falling Short and other Digital Transactions News briefs

Payments provider NXT-ID Inc. announced its FitPay Inc. subsidiary is providing the payments technology for the vivoactive 3, a new smart watch from Garmin International Inc. Dubbed Garmin Pay, the service supports contactless payments made with Visa Inc. and Mastercard Inc. credit and debit cards from major issuing banks. Earlier this week, Fitbit Inc. introduced Fitbit Pay. In …

Read More »Payments Professionals Diagnose What Ails Mobile Wallets

There wasn’t a Regular Joe in the room, but that didn’t stop a panel of payments professionals Tuesday from probing the consumer psyche to discern why mobile wallets aren’t more popular. As a percentage of point-of-sale transactions, most experts agree that the major general-purpose mobile wallets—Apple Pay, Android Pay, and …

Read More »Fitbit’s Newest Fitness Tracker Shows How the Card Brands Are Pushing Contactless

Consumers have a new option when choosing a fitness device that’s capable of making a contactless payment. Fitbit Inc., a San Francisco-based maker of fitness trackers, announced its Ionic smart watch Monday that includes Fitbit Pay, the company’s first foray into contactless payments. Fitbit Pay, which will be available when …

Read More »A Ten-Fold Boom in Mobile P2P Will Reward Providers But Also Build Pressure for Fees

Now that financial institutions have launched a digital peer-to-peer payment service called Zelle to battle popular nonbank services like Venmo, the rival platforms are likely to divide up a rapidly growing market but will also face pressure to find ways to charge for the service. While overall U.S. P2P dollar …

Read More »USA Technologies Swings to Profit as Network Continues Growing

USA Technologies Inc., a provider of payment services for vending machines and other unattended merchant locations, said Tuesday the number of connections in its ePort network grew 32% year-over-year to 568,000 as of June 30, and transaction volume nearly as much. The Malvern, Pa.-based firm also reported net income of …

Read More »Despite Obstacles, U.S. Contactless Payments Will Reach 34% in Five Years, Forecaster Says

It’s what some may consider a bold forecast for contactless payments in the United States, but Juniper Research is predicting that, by 2022, 34% of electronic payments will be contactless, up from less than 2% in 2017. United Kingdom-based Juniper released its forecast Monday in a report called “POS and …

Read More »