Identity and verification services firm AU10TIX released its “2024 Report on Global Identity Fraud” that found 54% of attacks in the first quarter were against the payments sector but declined to 43% by the fourth quarter because of tougher law enforcement. Euronet Worldwide Inc., a U.S.-based processor operating in Europe, said that …

Read More »Peer-to-Peer Platform Zelle Handled a Record $1 Trillion in Volume In 2024

Zelle, the peer-to-peer payments service from Early Warning Services LLC, announced early Wednesday that dollar volume sent over the network last year totaled a record $1 trillion, up 27% from 2023. Transactions for the year totaled 3.6 billion, a 25% year-over-year increase, while the number of consumer and business accounts …

Read More »Eye on Travel: Cruise Line Gets Onboard With PayPal; Worldline And Freedom Eye Travel Expansion

It may be the midst of winter, but some payment companies are preparing for the travel season. Travelers booking passage on a Norwegian Cruise Line ship can now use their PayPal Holdings Inc. digital wallet to pay for their cruises. PayPal says the payment option is available for trips with …

Read More »One Inc’s Banner 2024 and other Digital Transactions News briefs from 2/12/25

One Inc, a payments platform for the insurance industry, reported it signed 87 new agreements in 2024, with revenue up 55% for the year. The company exited the year at an annual run rate of $100 billion in processing volume, it said. Corpay Inc. said its cross-border payments platform launched Multi-Currency …

Read More »Worldpay Is Doing Well, But It’s Not a ‘Growth Driver’ for FIS, Execs Say

Top executives at FIS Inc. early Tuesday reported accelerating revenue in 2024 and see that momentum carrying into the new year, but the energy appears to be coming from financial technologies apart from the big Worldpay merchant-processing platform. “Worldpay has not been a growth driver in 2024, and won’t be …

Read More »Paysafe Offloads Part of its Business and other Digital Transactions News briefs from 2/11/25

Paysafe Ltd. has agreed to sell its direct marketing payment processing business, including reseller and merchant contracts, to Kort Payments, a company run by Joel Leonoff, Paysafe’s founder and former chief executive. Terms were not announced. Paysafe said this business “consists of direct marketing and other card-not-present volume in both complex …

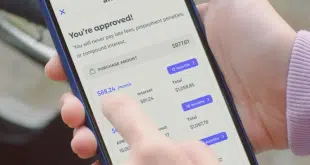

Read More »Eye on BNPL: Affirm’s Toothy Win; Gateway Adds Klarna Integration

Coast Dental, a dental practice with 100 locations in Florida, Georgia, and Texas, added Affirm’s buy now, pay later payment options. In related news, Decta Ltd., a United Kingdom-based fintech, has integrated Klarna AB’s BNPL service into its white-label payment gateway. Tampa, Fla.-based Coast Dental says the Affirm payment option …

Read More »Square’s Funny Restaurant Pitch and other Digital Transactions News briefs from 2/10/25

Acquirer Square released a new video series called “Running a Restaurant Is No Joke” that uses humor to highlight how Square can help restaurant operators. Now live on Square’s Web site, the series also will appear in various media and social outlets. RedotPay, a digital-currency payments platform, said it is working with …

Read More »Paysafe’s Shares Climb As Wall Street Buzzes With Takeover Talk

Paysafe Ltd., one of the world’s largest payments processors, has developed a highly sophisticated stake in online gaming, but lately the odds may favor a change in ownership for the publicly held London-based company, according to industry speculation. News emerged late Thursday that the company’s current valuation–$1.4 billion, down from …

Read More »Affirm Revenue up 47% and other Digital Transactions News briefs from 2/7/25

Buy now, pay later specialist Affirm Holdings Inc. reported $866.4 million in revenue for its fiscal second quarter ending Dec. 31, up 46.4% from $591.1 million in the year prior quarter. With a profit of $80.4 million, Affirm reversed last year’s quarterly loss of $166.9 million. Among other metrics for the quarter, …

Read More »